Introduction

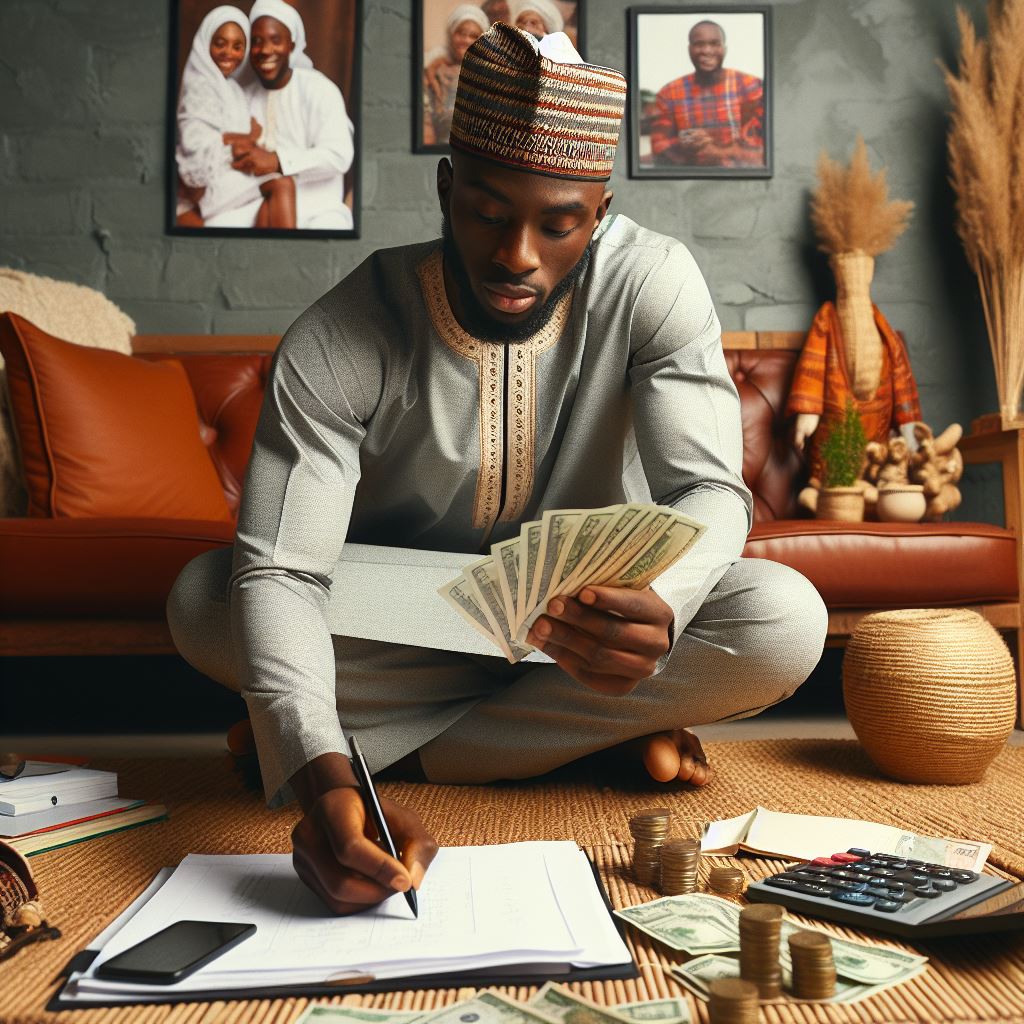

Embarking on the journey of parenthood in Nigeria demands meticulous financial planning. The intricacies of child costs necessitate a strategic approach.

Understanding the economic landscape is paramount as Nigeria, like many countries, experiences inflationary pressures that directly impact child-rearing expenditures.

In a nation where education, healthcare, and daily essentials continually evolve in cost, planning finances for raising children becomes a crucial aspect of responsible parenting.

The importance of financial planning extends beyond providing basic necessities.

It encompasses securing a child’s future through quality education, a healthcare safety net, and overall well-being.

Active preparation is a proactive stance against the unforeseen economic shifts, ensuring parents are equipped to navigate the rising costs of child-rearing in Nigeria.

The first step in this journey is acknowledging the dynamic nature of expenses associated with children, from infancy to adolescence.

This post will delve into the nuanced landscape of child costs, offering practical insights and actionable strategies to empower parents in navigating the financial complexities of raising children in Nigeria.

Read: School Fee Struggles? Here’s What Parents Can Do

Factors to Consider When Planning Child Costs

Basic Necessities

When planning your finances for raising a child in Nigeria, it is crucial to consider the basic necessities that they will require.

These necessities include food, clothing, and shelter.

- Food: The cost of feeding a child can be significant, considering their growing bodies and nutritional needs. It is important to budget for a well-balanced diet that includes fruits, vegetables, proteins, and grains.

- Clothing: Children outgrow their clothes quickly, so it is essential to allocate funds for purchasing new clothing regularly. This includes items such as shirts, pants, shoes, and other necessary accessories.

- Shelter: Providing a safe and comfortable living environment for your child is vital. Consider the costs of rent or mortgage payments, utility bills, and necessary home repairs or improvements.

Healthcare and Medical Expenses

Ensuring your child’s health is an essential part of their wellbeing. It is crucial to factor in healthcare expenses when planning your finances.

- Vaccinations: Vaccinations are essential for protecting your child from preventable diseases. They can be costly, so it is essential to include these expenses in your budget.

- Regular check-ups: Routine medical check-ups are necessary for monitoring your child’s growth and development. These visits may include general check-ups, visits to specialists, or necessary lab tests.

- Potential emergencies: Children are prone to accidents and illnesses, so it is essential to set aside funds for unexpected medical emergencies. This could include hospital visits, emergency room expenses, or medication.

Education and Schooling

Investing in your child’s education is vital for their future success. It is important to allocate funds specifically for their educational needs.

- School fees: Whether your child attends a public or private school, there will be associated costs. These fees may include tuition, registration fees, examination fees, and miscellaneous charges.

- Textbooks: Textbooks are essential tools for learning, and they can be quite expensive. Budget for the cost of textbooks required for each academic year or consider alternative options such as borrowing or buying used books.

- Uniforms: Many schools have specific dress codes or uniforms that must be followed. Allocate funds for purchasing uniforms or clothes that adhere to the school’s guidelines.

- Extracurricular activities: Participating in extracurricular activities can enrich your child’s education and personal development. However, these activities often have associated costs, such as club fees, sports equipment, or transport.

By considering these factors when planning your child’s costs in Nigeria, you can ensure that you have a comprehensive financial plan that adequately provides for their needs.

Read: Budgeting for Baby: Essentials for Nigerian Parents

Your Personalized Financial Plan

Get expert financial advice tailored exclusively to your goals. Receive a custom roadmap in just 1-3 business days.

Get StartedGain More Insights: Love’s Cost: Handling a Partner’s Overspending

Strategies for Planning Child Costs

When it comes to planning your finances, especially for child-related costs in Nigeria, it is crucial to have a strategic approach.

In this blog section, we will explore various strategies that can help you effectively plan for the expenses that come with raising a child.

Creating a Budget

Creating a comprehensive budget tailored specifically for child-related expenses is the first step towards effective financial planning.

By having a budget in place, you will have a clear understanding of your expenses and can allocate funds accordingly.

To create a budget, start by listing all the expenses associated with raising a child.

This can include food, clothing, education, healthcare, and extracurricular activities. Be thorough and consider all possible costs.

After listing the expenses, prioritize them based on importance and urgency.

Allocate a specific amount of your monthly income to each expense category. Make sure to leave some room for unexpected expenses as well.

Sticking to the budget is equally important. To ensure you stay on track, consider these tips:

- Track your expenses regularly and make adjustments if necessary.

- Minimize unnecessary spending by distinguishing between needs and wants.

- Reduce your debt and avoid accumulating new debts by managing your financial obligations responsibly.

Saving for Future Expenses

Apart from creating a budget, it is essential to save for future child-related costs.

By starting early and setting up a savings plan, you can be better prepared for significant expenses like education or unforeseen emergencies.

Consider the following saving strategies:

- Open a dedicated savings account: Having a separate account specifically for child-related expenses can help you track your savings progress and avoid unnecessary spending.

- Utilize investment options: Explore long-term investment options such as fixed deposits or mutual funds that offer higher returns, ensuring your savings grow over time.

Remember, consistency is key. Set aside a specific amount from your monthly income for savings and make it a non-negotiable expense.

Unlock a Debt-Free Future with Our Unique Strategies

Imagine a life unburdened by debt—a reality we help you visualize and achieve. We offer personalized strategies tailored to your unique situation, guiding you step-by-step toward financial freedom.

Start TodayAutomating the transfer of funds to your savings account can help you stay consistent.

Exploring Government Support and Policies

In Nigeria, there are government assistance programs, grants, subsidies, and tax benefits available to help reduce child-related costs.

It is essential to be aware of these support systems and take advantage of them whenever possible.

Research and inquire about the following:

- Government assistance programs: These programs can provide financial aid, healthcare coverage, or educational support for low-income families.

- Grants and subsidies: Certain organizations or institutions offer grants and subsidies specifically for child-related expenses like education or healthcare.

- Tax benefits: Familiarize yourself with tax deductions or credits available for parents, such as deductions for education expenses or child tax credits.

By exploring these government support systems and policies, you can significantly alleviate the burden of child costs and ensure better financial stability for your family.

In conclusion, planning your finances for child-related costs in Nigeria requires careful consideration and strategic decision-making.

Create a comprehensive budget, save for future expenses, and explore available government support to ensure you provide the best for your child while maintaining financial stability.

Read: Are You Financially Ready for a Baby? Key Signs

Additional Tips for Financial Planning

When it comes to financial planning for your child’s costs in Nigeria, there are additional tips that can help you stay on top of your finances and ensure a secure future for your family.

Prioritizing Needs vs. Wants

One crucial aspect of financial planning is distinguishing between essential needs and non-essential wants.

As parents, it’s important to prioritize the needs of your child and focus on providing them with the essentials for their well-being.

When planning child costs, encourage parents to carefully assess their expenses and differentiate between what their children truly need and what they merely want.

This can help in avoiding unnecessary expenses that may strain your budget.

Furthermore, providing guidance on making informed decisions about discretionary expenses can be beneficial.

Unlock Untapped Nigerian Wealth with Our Expert Advice

Imagine accessing investment opportunities others overlook—stocks, bonds, real estate, small businesses tailored to you. We offer personalized advice you won't find elsewhere, guiding you to financial success.

Unlock WealthDiscuss the importance of evaluating the value and necessity of discretionary purchases, ensuring that they align with your financial goals and priorities.

Seeking Financial Advice

Another valuable tip for effective financial planning when it comes to child costs is seeking professional financial advice.

Consulting with experts in the field can offer valuable insights and strategies to optimize your financial situation.

Highlight the benefits of seeking professional financial advice, such as gaining access to expert knowledge and personalized recommendations.

Financial advisors can provide tailored advice based on your specific circumstances, helping you make well-informed decisions regarding your child’s financial needs.

Recommend attending financial planning workshops or seminars where you can learn more about managing child costs effectively.

These events provide an opportunity to connect with financial experts and gain a deeper understanding of financial planning strategies.

Building Emergency Funds

Unexpected expenses are an inevitable part of raising a child. To ensure financial stability, it is essential to build and maintain an emergency fund.

Emphasize the importance of having a dedicated emergency fund specifically allocated to cover unexpected child-related expenses.

This fund should be easily accessible and separate from other savings or investments.

Provide practical tips on establishing and growing an emergency fund. Encourage parents to save a portion of their income regularly, even if it’s a small amount.

Automating savings can also be helpful to ensure consistent contributions.

Additionally, consider exploring options like opening a separate savings account specifically for emergency funds.

This can provide peace of mind knowing that you have a safety net for unforeseen financial needs related to your child.

In review, effectively planning your finances for your child’s costs in Nigeria requires careful consideration of needs versus wants, seeking professional financial advice, and building an emergency fund.

By implementing these additional tips, you can secure your child’s financial future and provide them with a solid foundation for growth and development.

Read: The Real Cost of Nigerian Weddings

Conclusion

Planning finances is crucial when raising children in Nigeria.

The main points discussed include the high cost of child expenses and the need for budgeting.

It is important to plan for education, healthcare, food, and other essentials for a child’s well-being.

Without proper financial planning, it can be challenging to meet the financial demands of raising children.

By being proactive and creating a budget, parents can ensure a stable financial future for their children.

Saving, investing, and seeking financial advice are essential in providing a secure and comfortable life for children.

Planning finances allows parents to be better prepared for unexpected expenses and emergencies.

It also helps in creating a good foundation for the child’s financial literacy and independence.

Ultimately, it is vital to understand the significance of financial planning in ensuring a bright future for Nigerian children.