Introduction

Money has a powerful influence on friendships, often causing conflicts and straining relationships.

It is essential to recognize that allowing friends to control our financial decisions can be detrimental.

Friendships are based on trust, shared experiences, and emotional support.

However, when money enters the picture, things can get complicated. Financial decisions have the potential to create rifts and even end friendships.

Money should not be the basis for our relationships; it should not influence the decisions we make.

Giving friends power over our finances can lead to manipulation, dependency, and resentment.

When friends have control over our financial choices, we surrender our autonomy and independence.

Making decisions based on their desires jeopardizes our own financial stability.

Friends may have good intentions, but their perspectives can be clouded by personal biases.

They may not have the necessary expertise to provide sound financial advice.

Moreover, financial decisions should be made based on individual circumstances and goals, not influenced by someone else’s values or objectives.

Each person’s financial journey is unique, and what works for one friend may not work for another.

By allowing friends to rule our financial decisions, we give them unwarranted power and influence.

This imbalance can create an unhealthy dynamic, where friends may feel entitled to dictate our financial choices.

In fact, it is crucial to maintain control over our financial decisions, even when it involves friendships.

Your Personalized Financial Plan

Get expert financial advice tailored exclusively to your goals. Receive a custom roadmap in just 1-3 business days.

Get StartedMoney should not be the driving force behind our relationships.

By asserting our independence and autonomy, we can protect the integrity of our friendships while ensuring our own financial well-being.

Let’s not let friends rule our financial lives.

Money and Friendship

Money and friendship, two powerful forces that often collide in the complex landscape of human relationships.

As we navigate the delicate dance between these realms, it’s crucial to establish boundaries and understand the potential pitfalls that may arise.

The relationship between money and friendship

The relationship between money and friendship is nuanced.

On one hand, friends share a deep bond built on trust, support, and shared experiences.

On the other, money introduces a transactional element that can complicate even the strongest connections.

It’s essential to define the parameters of financial involvement early on to avoid potential conflicts.

The common scenario of friends asking for financial favors

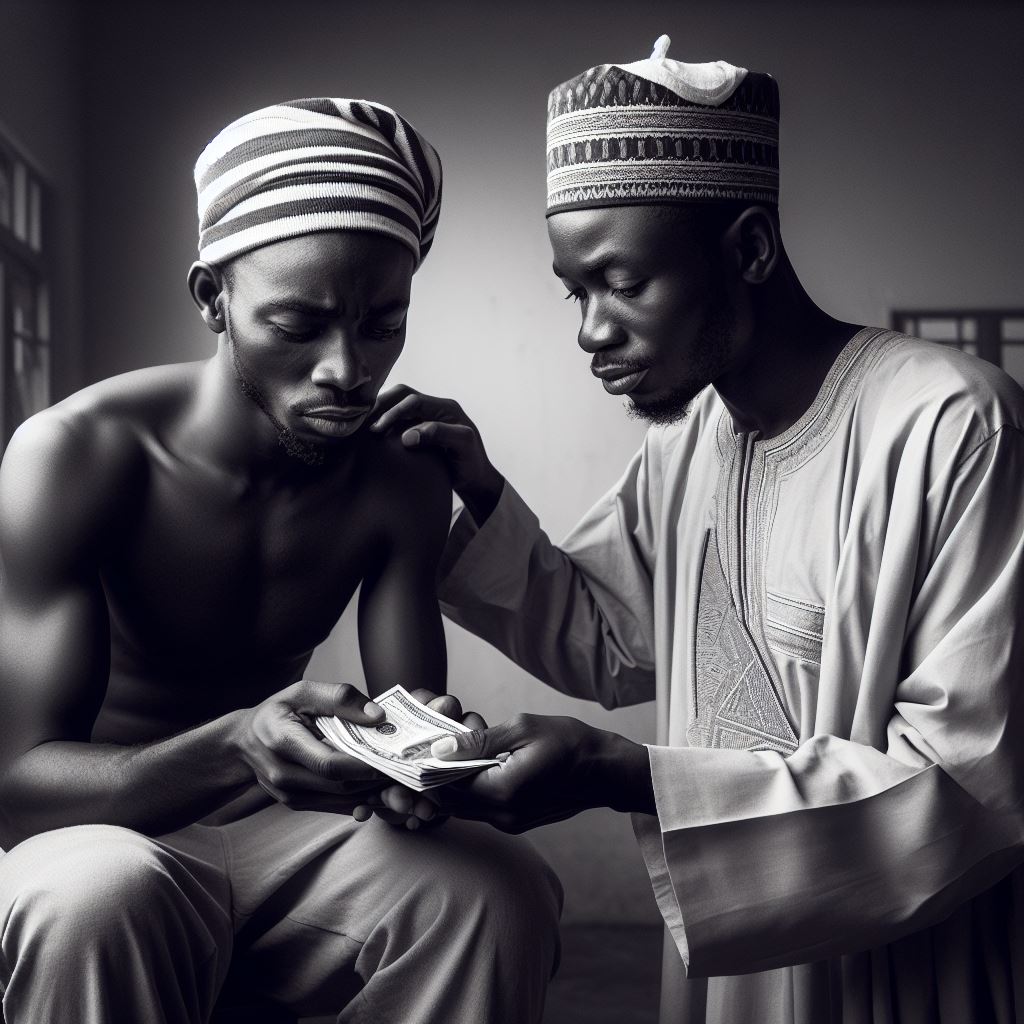

One common scenario that tests the boundaries of friendship is when a friend asks for a financial favor.

While helping a friend in need is a noble gesture, it can lead to unanticipated challenges.

Financial transactions between friends may create an imbalance in the power dynamic, potentially straining the relationship.

Moreover, the expectation of repayment can introduce stress and awkwardness, turning a genuine act of kindness into a source of tension.

It’s crucial for both parties to communicate openly about expectations and timelines, ensuring that financial transactions don’t overshadow the emotional connection that forms the foundation of the friendship.

Unlock a Debt-Free Future with Our Unique Strategies

Imagine a life unburdened by debt—a reality we help you visualize and achieve. We offer personalized strategies tailored to your unique situation, guiding you step-by-step toward financial freedom.

Start TodayThe potential issues and conflicts arising from financial transactions between friends

Issues may also arise when friends have different financial capacities.

While one may be comfortable lending or giving money, the other might struggle to reciprocate.

This discrepancy can breed resentment and inequality, eroding the trust that friendship relies upon.

To navigate the potential minefield of money and friendship, it’s important to approach financial matters with transparency, empathy, and clear communication.

Establishing ground rules and understanding each other’s financial boundaries can help maintain the delicate balance between being a good friend and a responsible steward of one’s financial well-being.

In short, while money may talk, it should not dictate the terms of friendship.

By navigating the intersection of these two powerful forces with care and consideration, we can ensure that our relationships remain strong, resilient, and free from the strains of financial conflicts.

Read: Relocation Costs: What Nigerians Must Know

Friends are not Financial Advisors

Friends are a crucial part of our lives. They provide emotional support, laughter, and companionship.

However, when it comes to financial matters, it’s important to remember that friends are not financial advisors.

While they may mean well, they may not have the necessary expertise in personal finance to provide sound advice.

Seeking financial advice from friends can have its risks, and it’s essential to consider these risks before making any financial decisions.

In this section, we will discuss the potential dangers of relying on friends for financial advice and encourage readers to consult professionals for expert guidance.

Lack of Expertise

It’s crucial to recognize that just because someone is a friend does not mean they are qualified to offer financial advice.

Unlock Untapped Nigerian Wealth with Our Expert Advice

Imagine accessing investment opportunities others overlook—stocks, bonds, real estate, small businesses tailored to you. We offer personalized advice you won't find elsewhere, guiding you to financial success.

Unlock WealthPersonal finance is a complex field, and specialized knowledge is required to make informed decisions.

Friends may not have the necessary expertise or qualifications to provide accurate guidance in areas such as investing, taxes, or retirement planning.

Relying solely on their advice can be risky and may lead to costly mistakes.

Biased Advice

Friends may have their own financial biases, whether conscious or unconscious.

They may be influenced by personal experiences, beliefs, or even their own financial goals.

This bias can cloud their judgment and result in advice that may not be aligned with your own financial objectives.

It’s essential to seek advice from professionals who can provide objective and unbiased recommendations that are tailored to your specific situation.

Potential Strain on Relationships

Money matters can be a sensitive topic, and seeking financial advice from friends can sometimes strain relationships.

If you choose to follow your friend’s advice and encounter negative outcomes, it may cause resentment or conflict.

Additionally, if friends feel pressured or obligated to offer financial advice, it can create unnecessary stress and strain on the friendship.

When it comes to money, it’s often best to keep friendships separate from financial decisions.

Consulting Professionals

Recognizing the limits of friends’ financial expertise, it’s wise to consult professionals for financial advice.

Financial advisors, accountants, and other money experts have the training and knowledge needed to provide accurate and objective recommendations.

They can help you navigate complex financial matters, tailor advice to your specific goals, and ensure you make informed decisions that align with your long-term financial well-being.

While friends play an important role in our lives, it’s crucial to acknowledge that they may not be the best source of financial advice.

Their lack of expertise, potential biases, and the strain it can put on relationships make them less reliable in financial matters.

Instead, it’s recommended to consult professionals who can provide specialized guidance.

By seeking advice from experts, you can make informed decisions and work towards securing your financial future.

Read: International Calling: Cheap Ways to Stay Connected

The Dangers of Loaning Money to Friends

The challenges and implications of loaning money to friends

In the intricate dance of friendship and finances, the temptation to assist a friend in need can be overpowering.

However, the seemingly noble act of loaning money to friends is not without its pitfalls. Let’s delve into the challenges and implications of this delicate scenario.

The potential strain on the friendship and relationship dynamics

The very essence of friendship is built on trust, understanding, and shared experiences.

However, introducing financial transactions into this equation can disturb the delicate balance.

One of the primary dangers lies in the potential strain on the friendship itself.

When money becomes a focal point, it can cast shadows on the genuine camaraderie that once thrived.

Unmet expectations, delayed repayments, or unforeseen circumstances can transform the dynamics, fostering resentment and animosity.

Furthermore, the implications extend beyond emotional strain.

Financial transactions between friends are often informal and lack the legal protection that accompanies more traditional lending channels.

This informal nature can lead to misunderstandings and disputes, jeopardizing the very foundation of the relationship.

Alternative ways to help friends financially without lending money

So, what alternatives exist for those who genuinely want to help their friends without jeopardizing their bonds? One effective approach is to provide support in ways that don’t involve direct monetary transactions.

Offer guidance in budgeting, help them explore available resources, or assist in finding part-time employment opportunities.

By doing so, you empower your friend to overcome financial challenges without compromising the integrity of your relationship.

Another option is to explore crowdfunding platforms or community-based resources. Encourage your friend to share their story with a wider audience, allowing those who wish to contribute to do so voluntarily.

This way, the financial burden is shared among a larger community, reducing the strain on any single friendship.

In essence, while the desire to help friends in financial need is commendable, caution must be exercised when considering direct monetary assistance. The dangers of loaning money to friends are real and can have lasting consequences.

By exploring alternative avenues of support, you not only protect your friendship but also contribute to a more sustainable and resilient community.

Read: Saying No: A Money-Saving Skill

Setting Boundaries

In the complex dance of friendship, one delicate move can alter the entire rhythm.

When it comes to finances, it’s crucial to establish boundaries to ensure that the harmony remains intact.

Setting financial boundaries with friends may feel awkward, but it’s a vital step in maintaining both your financial health and the integrity of your relationships.

Importance of Setting Boundaries

Money is a sensitive subject, and mixing it with friendships can be a recipe for disaster if not approached carefully.

Establishing clear financial boundaries helps prevent misunderstandings, resentment, and potential damage to your relationship.

It allows you to protect your financial goals and maintain a healthy balance between generosity and self-preservation.

Tips for Communicating Boundaries Effectively

- Be Proactive: Don’t wait for a financial conflict to arise. Initiate a conversation about money early on, setting the tone for open communication.

- Choose the Right Time: Select a neutral and calm setting for discussing financial matters. Avoid doing so in the midst of a celebration or a crisis to ensure both parties are receptive.

- Use “I” Statements: Frame your boundaries as personal preferences rather than making accusatory statements. For example, say, “I prefer not to lend money” instead of “You always ask for money.”

- Be Specific: Clearly define your boundaries. Whether it’s about splitting bills, lending money, or sharing expenses, the more specific you are, the less room there is for misunderstandings.

- Listen Actively: Encourage your friend to share their financial boundaries as well. This fosters a mutual understanding and demonstrates that the conversation is not one-sided.

Encouraging Open and Honest Conversations

Transparency is the cornerstone of healthy friendships. Encourage open discussions about money by creating a judgment-free zone.

Share your financial goals, challenges, and successes to inspire your friends to do the same.

By fostering an environment of trust and understanding, you pave the way for stronger, more resilient friendships.

In the realm where money talks, let your voice be one of reason and prudence.

Setting financial boundaries may feel uncomfortable initially, but in the long run, it’s a gesture of respect for both your finances and your friendships.

After all, a true friend understands the value of both your relationship and your financial wellbeing.

Read: Free Attractions: Enjoying Cities with No Cost

The Role of Financial Independence in Friendships

The significance of financial independence in maintaining healthy friendships

In the intricate dance of human relationships, the rhythm of friendship can sometimes be disrupted by the harsh discord of financial strain.

Money, though an uncomfortable topic, plays an undeniable role in the health of our connections.

In this section, we unravel the importance of financial independence in preserving the delicate fabric of friendship.

Picture this: a friend in need is a friend indeed, but what happens when the need extends beyond emotional support to financial assistance? While helping friends in times of crisis is a noble endeavor, it’s essential to recognize the potential impact on the dynamics of the relationship.

Financial interdependence can create an unspoken power dynamic, altering the balance and introducing an element of strain.

The potential impact of relying on friends for financial support

Relying on friends for financial support may lead to a subtle erosion of trust and a shift in the foundations of the relationship.

Unintentionally, the borrower may find themselves in the uncomfortable position of owing not just money but also a piece of their autonomy.

Meanwhile, the lender may struggle with the burden of unmet expectations or resentment.

To safeguard the purity of our connections, it becomes imperative to cultivate financial independence. When each individual in a friendship is self-sufficient, the bond can thrive on mutual respect and shared experiences rather than financial transactions.

Financial independence acts as a shield, protecting friendships from the corrosive effects of monetary entanglements.

Encouragement for readers to work towards financial independence

This is not a call for a cold and calculated approach to friendships but rather a plea for balance.

Striving for financial independence isn’t about isolation; it’s about creating a foundation that allows friendships to flourish organically.

It’s an investment in the longevity of connections, ensuring that when we lean on each other, it’s for emotional support, not just financial.

In a nutshell, as we navigate the complexities of human connections, let us not underestimate the impact of financial independence.

Let our friendships be built on the solid ground of self-sufficiency, where the currency is love, trust, and shared joy, not the weight of financial obligations.

It’s time to liberate our friendships from the shackles of financial dependency and let them soar on the wings of mutual respect and understanding.

Nurturing Strong Friendships without Money

Making and maintaining strong friendships is an essential part of a fulfilling life.

However, in a society that often equates worth with financial status, it can be challenging to nurture friendships without the involvement of money.

Here are some alternative ways to build and sustain meaningful connections that are not dependent on financial transactions.

Quality Time

Investing time in your friendships is crucial for their growth. Instead of going out for expensive dinners or planning lavish outings, opt for simpler and more affordable activities.

Arrange a movie night at home, have a picnic in the park, or explore your local community together.

The focus should be on spending quality time and creating memories, rather than spending money.

Shared Hobbies or Interests

Discovering shared hobbies or interests can strengthen bonds with friends without breaking the bank.

Engage in activities that you both enjoy, such as hiking, painting, cooking, or playing a sport.

Not only will this give you an opportunity to spend time together, but it will also deepen your connection through shared experiences and common interests.

Supportive Conversations

Friendships thrive on emotional support and genuine connections.

Take the time to have meaningful conversations with your friends, where you listen actively and provide support.

Discussing personal goals, challenges, and dreams can create a bond that goes beyond materialistic exchanges.

Being there for each other during times of need strengthens friendship and demonstrates the value of emotional support.

Celebrate Milestones

Acknowledging and celebrating milestones in your friends’ lives is a wonderful way to nurture your relationships.

Whether it’s birthdays, promotions, or personal achievements, showing genuine interest and celebrating these milestones together creates a strong sense of camaraderie.

Simple gestures like writing heartfelt cards or organizing a small gathering can make a significant impact and show that you value their accomplishments.

Acts of Kindness

Performing acts of kindness for your friends is an effective way to nurture relationships without relying on monetary transactions.

Help them with errands, offer a listening ear, or surprise them with small thoughtful gestures.

These acts not only strengthen your bond but also establish a sense of reciprocity, fostering trust and mutual support.

Gratitude and Appreciation

Expressing gratitude and appreciation is essential in any friendship, regardless of financial involvement.

Take the time to show your friends that you value and appreciate their presence in your life.

Simple gestures like saying “thank you,” writing a heartfelt note, or complimenting them for their unique qualities can go a long way in nurturing strong friendships.

All in all, nurturing strong friendships is possible without money.

By prioritizing quality time, shared interests, supportive conversations, celebrating milestones, performing acts of kindness, and expressing gratitude, you can build and sustain meaningful connections that are not based on financial transactions.

Remember, true friendships are built on emotional support, genuine connections, and shared experiences, not the size of your wallet.

Conclusion

In this blog post we discussed the negative impact of allowing friends to rule our finances.

We explored how this can lead to financial instability and strained relationships. It is crucial for individuals to maintain control over their financial decisions.

It is easy to get influenced by friends who may have different priorities or financial habits, but it is imperative to prioritize our own financial well-being.

By taking charge of our finances, we can ensure a secure future and avoid unnecessary stress.

Ultimately, healthy friendships are built on trust, support, and understanding, rather than financial dependency.

It is crucial to have open conversations with friends about money and ensure that financial decisions align with personal goals.

We must remember that financial independence allows us to make choices that are best for us without compromising our relationships.

It empowers us to achieve our long-term goals and build a stable financial foundation.

In the end, maintaining control over our financial decisions is vital. While friendships are important, it is equally important to prioritize our financial well-being and strive for independence.

By making responsible financial choices, we can create a better future for ourselves and nurture meaningful relationships.