Introduction

In a world that often encourages saying yes to opportunities and experiences, mastering the art of saying no emerges as a powerful and overlooked money-saving skill.

Saying no doesn’t simply imply rejection; it’s a deliberate choice to prioritize financial well-being over momentary pleasures.

This skill involves assessing the true cost of commitments and having the courage to decline those that don’t align with our financial goals.

The significance of honing the ability to say no in the context of personal finance cannot be overstated.

Many financial pitfalls stem from overcommitting – financially, socially, or professionally.

Whether it’s resisting impulse purchases, declining unnecessary subscriptions, or turning down costly social events, saying no is a multifaceted skill that can significantly impact our financial stability.

Understanding its importance is the first step toward cultivating a healthier relationship with money.

This blog post aims to explore the nuances of saying no as a money-saving skill, offering practical insights and strategies to implement in various aspects of life.

Understanding the psychological aspects of saying no is crucial for effective implementation.

We’ll delve into the fear of missing out (FOMO) and societal pressures that often drive us to say yes when we should say no.

By unraveling these factors, readers can gain a deeper understanding of their own motivations and make informed decisions.

This post will focus on specific scenarios where saying no can have a direct impact on one’s financial health.

In fact, this blog post aims to empower readers with the knowledge and tools needed to confidently embrace the money-saving skill of saying no.

By strategically applying this skill, individuals can steer their financial journeys toward stability, resilience, and ultimately, financial freedom.

Understanding the Impact of Saying Yes

In a world that often glorifies the virtue of saying “yes” to every opportunity, it’s crucial to comprehend the profound impact it can have on our financial well-being.

Your Personalized Financial Plan

Get expert financial advice tailored exclusively to your goals. Receive a custom roadmap in just 1-3 business days.

Get StartedLet’s delve into the consequences of being unable to say no.

The Consequences of Always Saying Yes

- Financial Strain: One of the most palpable consequences of perpetual agreement is the toll it takes on our wallets.

Whether it’s agreeing to pick up the tab at every dinner or constantly investing in non-essential purchases, the cumulative effect can lead to a significant financial strain. Learning to decline certain expenditures is an essential step towards a healthier financial future. - Increased Spending: Saying yes too often opens the floodgates to increased spending. Every affirmative response may translate into an additional expense, pushing your budgetary limits.

This perpetual cycle of indulgence can lead to financial instability and hinder your ability to achieve long-term financial goals. - Regret and Dissatisfaction: Constantly saying yes can result in feelings of regret and dissatisfaction. The purchases made or commitments undertaken may not align with your true desires or values, leading to a sense of disappointment.

Over time, this can erode your overall satisfaction and well-being.

The Reasons Behind Difficulty Saying No

- Fear of Missing Out (FOMO): The fear of missing out on opportunities or experiences is a powerful motivator. However, succumbing to FOMO can lead to impulsive decisions that may not align with your financial goals.

Understanding that not every opportunity is a must-seize moment is crucial for financial stability. - Desire to Please Others: The innate desire to please those around us can make saying no challenging. However, it’s essential to recognize that prioritizing others’ expectations over your financial well-being can have detrimental effects.

Learning to strike a balance between generosity and financial prudence is key. - Lack of Assertiveness Skills: Difficulty saying no often stems from a lack of assertiveness skills. Building these skills can empower you to communicate your boundaries effectively, leading to more intentional and financially sound decisions.

In fact, embracing the power of “no” is not just a money-saving skill; it’s a cornerstone of financial well-being.

Understanding the consequences of perpetual agreement and addressing the root causes can pave the way for a more secure and satisfying financial future.

Read: Free Attractions: Enjoying Cities with No Cost

The Benefits of Saying No

In a world that often encourages a perpetual “yes” mentality, mastering the art of saying “no” can be a powerful tool for improving various aspects of our lives.

When it comes to personal finances, the benefits of embracing this two-letter word extend far beyond mere savings.

Increased Financial Well-Being

One of the most immediate advantages of saying “no” is the positive impact on your financial health.

Every time you decline an unnecessary expense, you are essentially saving money.

Whether it’s resisting the urge to indulge in an impulse purchase or turning down social invitations that come with hefty price tags, the cumulative effect of these decisions contributes to a more robust financial foundation.

Saying “no” enables you to prioritize your financial goals, from building an emergency fund to investing for the future.

Improved Decision-Making

Saying “no” requires careful consideration and evaluation of your priorities.

As you become adept at declining opportunities that don’t align with your goals, you develop a sharper focus on what truly matters.

This improved decision-making spills over into your financial choices, guiding you towards investments that align with your objectives and steering you away from unnecessary expenditures that might hinder your progress.

Enhanced Self-Control and Discipline

Mastering the ability to say “no” cultivates self-control and discipline.

Unlock a Debt-Free Future with Our Unique Strategies

Imagine a life unburdened by debt—a reality we help you visualize and achieve. We offer personalized strategies tailored to your unique situation, guiding you step-by-step toward financial freedom.

Start TodayIt’s about recognizing the difference between short-term gratification and long-term success.

By consistently exercising restraint in your spending habits, you build the mental resilience necessary to navigate the financial challenges life throws your way.

Reduced Stress and Anxiety

Financial stress is a common ailment in today’s fast-paced world.

However, by embracing the power of “no,” you can significantly reduce stress and anxiety associated with money matters.

A well-curated financial plan, rooted in the ability to decline non-essential expenses, provides a sense of security and peace of mind.

In short, saying “no” is not merely a money-saving skill but a life-enhancing one.

The benefits extend beyond financial savings to encompass improved decision-making, heightened self-discipline, and a reduction in stress.

As you embrace the art of saying “no,” you’ll find yourself on a path to greater financial well-being and a more fulfilling life.

Read: 5 Ways to Resist Friends’ Spend Thrills

Strategies for Saying No Effectively

Saying no can be a powerful tool in the quest for financial freedom.

Mastering this skill requires a combination of self-awareness, assertiveness, and a strong support system.

Let’s delve into effective strategies that can transform your ability to decline financial commitments with grace.

Assessing Personal Financial Goals and Priorities

- Setting Clear Financial Objectives: Begin by defining your financial goals. Whether it’s saving for a dream vacation, buying a home, or investing for retirement, having clear objectives provides a foundation for saying no to expenses that deviate from your path.

- Identifying Financial Boundaries: Understand your financial limits and establish boundaries. This ensures that your decisions align with your long-term objectives, preventing impulsive spending that could hinder your financial growth.

Practicing Assertiveness Techniques

- Using “I” Statements: Express your decisions using “I” statements to assert your perspective without sounding confrontational. For example, say, “I am currently focusing on saving for a home,” rather than a blunt “I can’t afford it.”

- Offering Alternative Suggestions: Propose alternative solutions to demonstrate your commitment to the relationship or activity. Suggesting cost-effective alternatives or free activities can maintain connections without compromising your budget.

Building a Support Network

- Surrounding Oneself with Like-Minded Individuals: Connect with people who share similar financial values. Being in a supportive environment makes it easier to decline activities that conflict with your financial goals.

- Seeking Accountability Partners: Having someone to hold you accountable can strengthen your resolve. Share your financial goals with a trusted friend or family member who can remind you of your objectives when faced with tempting opportunities.

Understanding the Power of Delayed Gratification

- Weighing Short-Term Desires Against Long-Term Goals: Recognize the trade-offs between immediate gratification and long-term financial success. Saying no to small indulgences today could mean saying yes to significant achievements tomorrow.

- Exploring the Concept of Opportunity Cost: Understand that every financial decision involves an opportunity cost. By saying no to one expense, you open the door to potentially more meaningful and impactful financial choices.

By incorporating these strategies into your life, you’ll not only enhance your ability to say no effectively but also pave the way for a more secure financial future. Embrace the power of no, and watch your savings grow.

Read: Transport Tips: Save on Getting Around Abroad

Unlock Untapped Nigerian Wealth with Our Expert Advice

Imagine accessing investment opportunities others overlook—stocks, bonds, real estate, small businesses tailored to you. We offer personalized advice you won't find elsewhere, guiding you to financial success.

Unlock Wealth

Real-Life Scenarios: Saying No in Different Situations

Saying No to Unnecessary Expenses

One of the key aspects of mastering the art of saying no is recognizing unnecessary expenses.

Whether it’s the latest gadget or a tempting subscription service, learning to decline these non-essential purchases is crucial for financial stability.

Saying no to unnecessary expenses means prioritizing needs over wants and focusing on long-term financial goals.

Saying No to Impulsive Purchases

Impulse buying is a common trap that can quickly drain your wallet.

From flashy displays at the checkout counter to limited-time offers, there’s always something trying to lure you into an unplanned purchase.

Developing the ability to say no to impulsive buys empowers you to stick to your budget and avoid buyer’s remorse.

Saying No to Peer Pressure and Social Events

Social situations often come with financial expectations, whether it’s splitting a dinner bill evenly or attending expensive events.

Learning to gracefully decline invitations or suggest cost-effective alternatives is a valuable skill.

Saying no to social pressures allows you to maintain your budget without sacrificing your relationships.

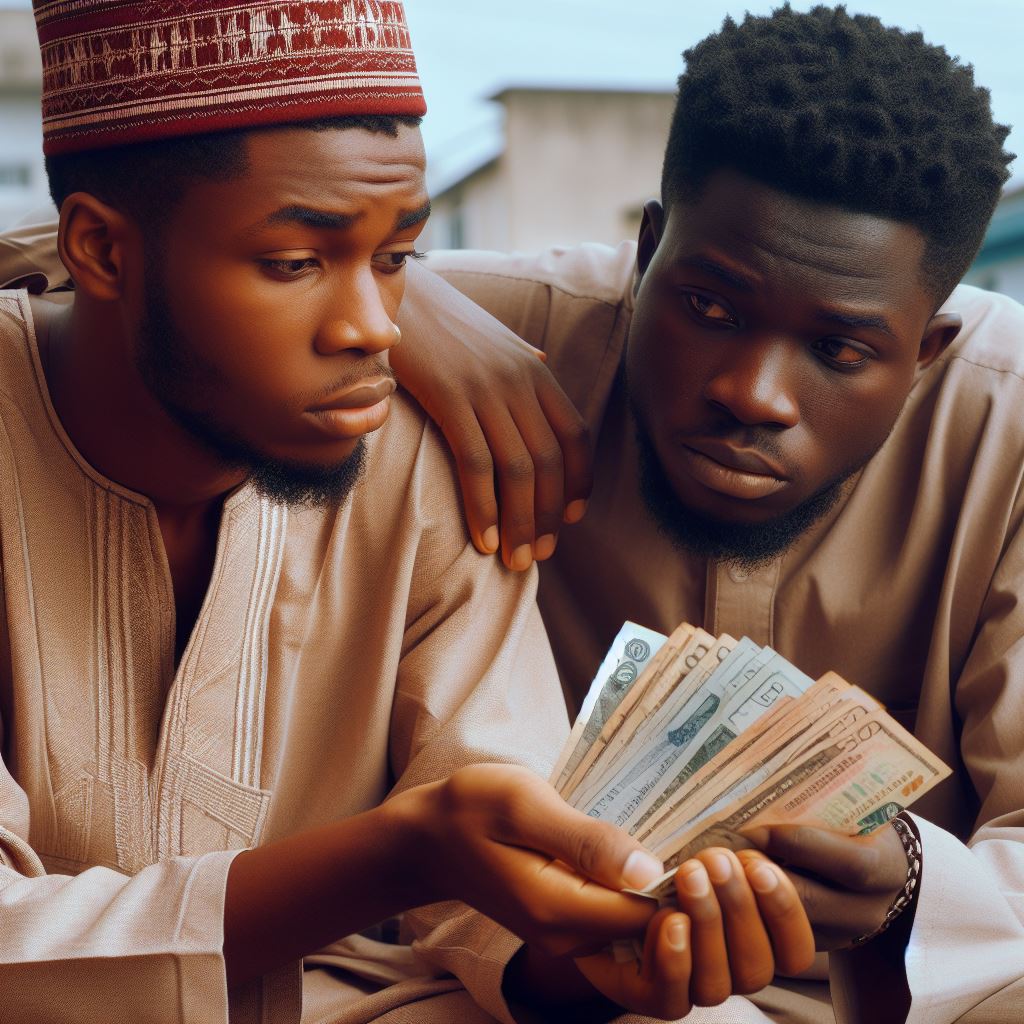

Saying No to Financial Requests from Friends and Family

Navigating financial requests from friends and family can be challenging.

While it’s natural to want to help, it’s essential to set boundaries.

Politely saying no to financial requests, or offering alternative support, prevents your generosity from jeopardizing your own financial well-being.

It’s about finding a balance between supporting loved ones and safeguarding your financial future.

In each scenario, saying no is not about deprivation but rather about making intentional choices that align with your financial goals.

By mastering the art of saying no, you gain control over your finances and pave the way for a more secure and prosperous future.

Remember, every “no” is a step towards financial empowerment.

Read: Chic & Cheap: Housewarming Planning 101

Overcoming Challenges and Staying Motivated

When it comes to saying no and saving money, there are several challenges that may arise.

However, with the right mindset and strategies, you can overcome these obstacles and stay motivated on your financial journey.

Dealing with feelings of guilt and fear

- Recognize that it is okay to prioritize your financial well-being and say no when necessary.

- Understand that guilt and fear are normal emotions, but they should not dictate your financial decisions.

- Challenge any negative thoughts or beliefs that may be fueling these feelings.

- Seek support from friends, family, or a financial advisor who can provide guidance and reassurance.

- Remind yourself of the long-term benefits and financial goals you are working towards.

Practicing self-care and self-compassion

- Set aside time for self-care activities that help you relax and reduce stress.

- Be gentle with yourself and recognize that saying no is an act of self-love and self-preservation.

- Take breaks when needed and prioritize your mental and emotional well-being.

- Practice positive affirmations and remind yourself of your worth beyond material possessions.

- Surround yourself with positive influences and engage in activities that align with your values.

Celebrating small wins and milestones

- Recognize and appreciate the progress you have made in saying no and saving money.

- Take time to celebrate your achievements, no matter how small they may seem.

- Reward yourself with non-monetary treats or experiences that bring you joy.

- Share your successes with a supportive community or loved ones who can cheer you on.

- Use these celebrations as motivation to continue on your financial journey.

Tracking progress and reviewing achievements

- Regularly track your spending and savings to see the tangible results of your efforts.

- Review your financial goals and adjust them if necessary based on your progress.

- Take note of any patterns or areas for improvement in your spending habits.

- Celebrate specific milestones, such as reaching a certain amount saved or paying off a debt.

- Use this review process to stay motivated and continuously learn and grow.

By effectively dealing with feelings of guilt and fear, practicing self-care and self-compassion, celebrating small wins, and tracking your progress, you can overcome challenges and stay motivated on your money-saving journey.

Remember, saying no is not just a money-saving skill; it is also a valuable tool for creating a more fulfilling and financially secure future.

Conclusion

Mastering the art of saying no is undeniably a powerful money-saving skill.

Throughout this post, we’ve delved into various scenarios where uttering a simple “no” can act as a financial safeguard.

From impulsive purchases to unwarranted commitments, recognizing the value of your resources and having the courage to decline is key to fiscal responsibility.

Saying no extends beyond a mere refusal; it is a strategic move that safeguards your financial health.

By turning down unnecessary expenses and unproductive investments, you are redirecting your resources towards what truly matters – your long-term financial goals.

Now, armed with the understanding of the financial benefits of saying no, it’s time to put this skill into practice.

Make a conscious effort to evaluate every financial decision, big or small. Assess whether it aligns with your goals and if it doesn’t, muster the strength to decline.

Remember, every no is a step closer to financial empowerment.

Practice makes perfect, and the more you exercise your ability to say no, the more resilient your financial fortress becomes.

You’ll find that as you hone this skill, not only will your savings grow, but your financial confidence will soar.

Saying no is not about deprivation; it’s about making intentional choices that align with your financial aspirations.

In the grand tapestry of personal finance, saying no is a thread that weaves together a secure future.

It is an indispensable tool that, when wielded wisely, can transform your financial landscape.

As you embark on this journey of fiscal responsibility, remember that every no is a yes to your financial well-being.