Introduction

Parents School Fee Struggles: Education is a fundamental aspect of a child’s life, providing the necessary knowledge and skills for their future.

However, the rising cost of school fees has become a major concern for many parents.

In this blog post, we aim to address this issue and provide helpful tips and strategies for parents facing school fee struggles.

Education plays a crucial role in shaping a child’s future, equipping them with the necessary tools to succeed in life.

It opens doors of opportunities and instills essential values such as discipline, critical thinking, and lifelong learning.

As parents, ensuring access to quality education for our children is of utmost importance.

Over the years, the cost of school fees has been on the rise, creating financial stress for parents.

Factors such as inflation, increasing operational expenses, and additional educational resources contribute to this escalating burden.

Many families find it challenging to meet these expenses, which can lead to compromised educational opportunities for their children.

The purpose of this blog post is to provide parents with practical strategies to overcome school fee struggles.

We will outline various options and resources available to help reduce financial strain, such as scholarships, financial aid programs, and seeking alternative education options.

Additionally, we will offer tips on budgeting wisely and engaging in open communication with schools to negotiate fees or explore flexible payment plans.

Navigating school fee challenges can be overwhelming, but there are solutions and support systems available.

By empowering parents with knowledge, we hope to alleviate some of the anxieties associated with school fee struggles and ensure that every child has access to quality education.

Stay tuned for our upcoming sections to discover effective ways to overcome this obstacle and provide the best education for your child.

Your Personalized Financial Plan

Get expert financial advice tailored exclusively to your goals. Receive a custom roadmap in just 1-3 business days.

Get StartedOverview of the common struggles parents face with school fees

In the intricate dance of providing our children with a quality education, parents often find themselves wading through the turbulent waters of school fees.

The challenges are real, and the journey can be overwhelming.

Let’s delve into the common struggles parents face and explore practical solutions to weather the storm.

Parents nationwide grapple with the financial strain of school fees, and understanding the common challenges is crucial.

Among these struggles are increasing school fees, limited income, unexpected expenses, and the absence of savings or emergency funds.

Increasing School Fees

The relentless surge in school fees has become a bitter reality for many parents.

It’s essential to stay informed about fee structures and anticipate potential increases.

Open communication with school administrations can lead to insights into the reasons behind hikes and potential options for financial assistance.

Limited Income

In a world where the cost of living seems to outpace income growth, parents often find themselves caught in a financial squeeze.

Crafting a detailed budget and exploring additional income streams can help alleviate this pressure.

Seek out part-time opportunities or freelancing gigs that complement your schedule and skills.

Unexpected Expenses

Life has a way of throwing unexpected curveballs, and these can wreak havoc on a carefully planned budget.

Establish an emergency fund specifically earmarked for school-related contingencies.

This financial buffer will provide peace of mind and a safety net during challenging times.

Unlock a Debt-Free Future with Our Unique Strategies

Imagine a life unburdened by debt—a reality we help you visualize and achieve. We offer personalized strategies tailored to your unique situation, guiding you step-by-step toward financial freedom.

Start TodayLack of Savings or Emergency Funds

Many parents operate on tight budgets without the luxury of savings.

It’s never too late to start building an emergency fund.

Consider cutting non-essential expenses, and redirect those funds toward a savings account dedicated to educational expenses.

In fact, facing school fee struggles head-on requires a combination of proactive financial planning, open communication with educational institutions, and the cultivation of a resilient mindset.

By acknowledging the challenges and implementing practical solutions, parents can navigate these financial waters more effectively, ensuring a smoother journey for both themselves and their children.

Read: Are You Financially Ready for a Baby? Key Signs

Budgeting and financial planning

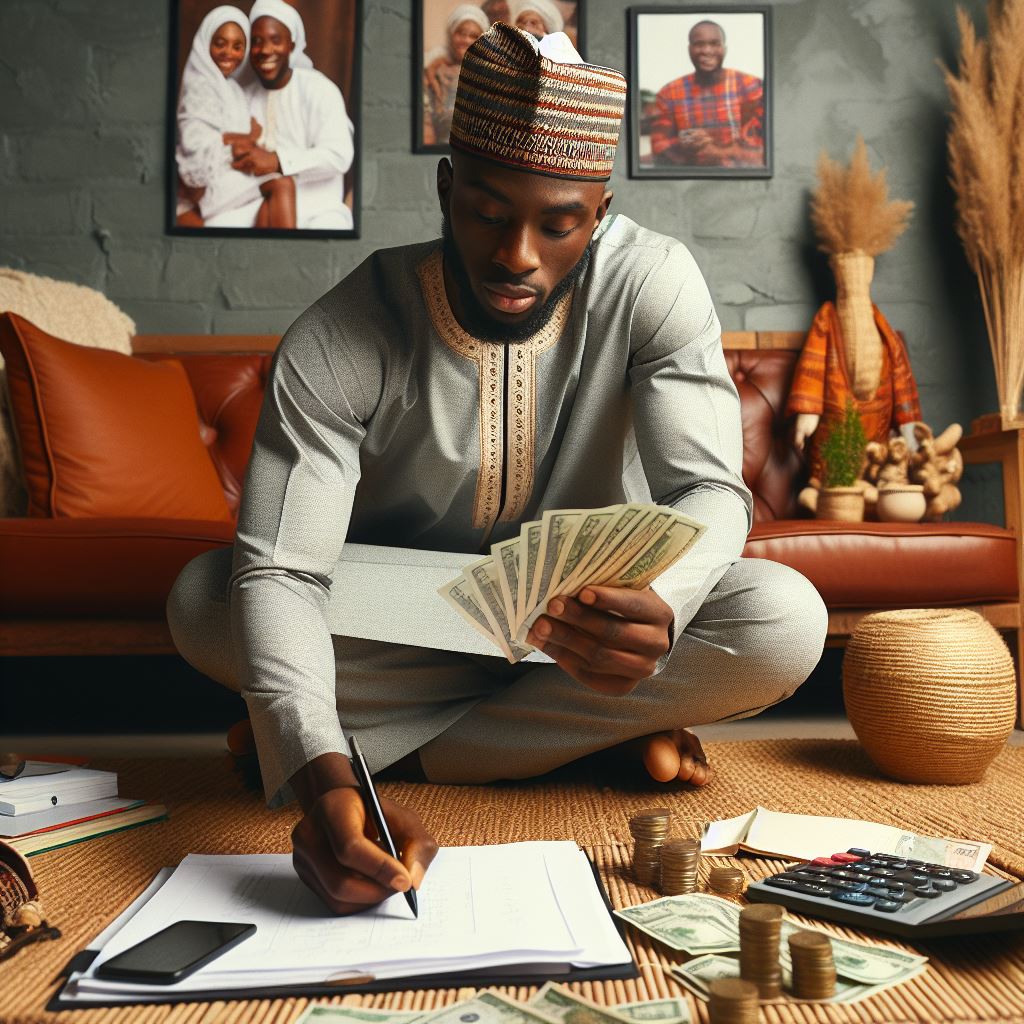

In the realm of parenting, one of the significant challenges that many families face is managing school fees.

The financial burden can be overwhelming, but with strategic budgeting and financial planning, parents can alleviate the stress and ensure their children’s education remains a top priority.

Calculate Total School Fees

The first step in tackling school fee struggles is to have a clear understanding of the total expenses involved.

Break down the fees into tuition, textbooks, uniforms, and any additional costs.

Knowing the exact amount you need to set aside allows for a more focused and effective budgeting strategy.

Create a Monthly Budget

Once armed with the total school fees, it’s time to create a monthly budget.

Factor in all income sources and allocate funds to cover necessary expenses, such as rent, utilities, groceries, and transportation.

Be realistic about your financial situation and set aside a specific portion of your income for school fees.

Unlock Untapped Nigerian Wealth with Our Expert Advice

Imagine accessing investment opportunities others overlook—stocks, bonds, real estate, small businesses tailored to you. We offer personalized advice you won't find elsewhere, guiding you to financial success.

Unlock WealthTrack Income and Expenses

Consistent tracking of both income and expenses is crucial for effective financial planning.

Utilize budgeting tools or apps to monitor your financial transactions.

This helps identify areas where you can cut costs or redirect funds toward school fees.

Prioritize Expenses

When financial resources are limited, prioritization becomes key.

Identify non-essential expenses and cut back where possible.

Prioritize spending on necessities like education while minimizing discretionary spending on luxuries.

Set Aside Money for School Fees

Make school fees a non-negotiable part of your budget.

By setting aside a specific amount each month, you ensure that when the due date arrives, you are financially prepared.

This disciplined approach helps prevent last-minute financial crises and allows for a smoother education funding process.

In short, navigating school fee struggles requires proactive budgeting and financial planning.

By understanding the total fees, creating a monthly budget, tracking income and expenses, prioritizing spending, and consistently setting aside money for school fees, parents can provide their children with the education they deserve without sacrificing their financial stability.

Read: The Real Cost of Nigerian Weddings

Research and explore financial aid options

Research and explore financial aid options such as scholarships, grants, tuition installment plans, educational loans, and sponsorship opportunities.

Financial aid can provide much-needed assistance to parents struggling with school fees.

There are several options available for those seeking financial support to help ease the burden of school fees.

By researching and exploring these options, parents can find the best financial aid solution for their needs.

Scholarships and grants

Scholarships and grants are a great way to receive financial assistance for school fees.

Many organizations, both private and public, offer scholarships and grants to deserving students.

These can cover a significant portion or even the entire school fees, depending on the scholarship or grant amount.

It’s essential for parents to research and apply for scholarships and grants that their child is eligible for.

Tuition installment plans

Tuition installment plans are another option for parents struggling with school fees.

Many schools offer installment plans that allow parents to pay the fees in several smaller installments instead of one lump sum.

This can make it more manageable for parents to pay the fees over a longer period, reducing financial stress.

Educational loans

Educational loans are also worth considering if parents require financial assistance.

Many financial institutions offer loans specifically for educational purposes.

These loans have favorable repayment terms and interest rates, making it easier for parents to pay back the borrowed amount.

It’s important for parents to compare different loan options and choose the one that best suits their financial situation.

Sponsorship opportunities

Sponsorship opportunities can also be explored by parents struggling with school fees.

Local businesses or organizations may be willing to sponsor a child’s education, either fully or partially.

Parents can reach out to potential sponsors and present their child’s academic achievements and future goals to increase their chances of securing sponsorship.

In order to make the most of these financial aid options, it is crucial for parents to do thorough research.

They should explore various websites, contact schools and financial institutions, and reach out to organizations offering scholarships and grants.

It may take time and effort, but the potential financial relief and opportunities for their child’s education are well worth it.

When researching financial aid options, parents should also consider the eligibility criteria and deadlines for each option.

Some scholarships and grants may have specific requirements, such as academic achievements or financial need.

By staying organized and keeping track of deadlines, parents can ensure they don’t miss out on any potential opportunities.

In essence, parents struggling with school fees have several financial aid options available to them.

By researching and exploring scholarships, grants, tuition installment plans, educational loans, and sponsorship opportunities, parents can find the best solution for their needs.

It’s important to start the research process early and stay organized to maximize the chances of securing financial assistance.

With the right financial aid, parents can provide their child with the education they deserve without the added financial burden.

Read: Can’t Pay Fees? Explore These Financial Aids Now

Seek assistance from the school

As the school year kicks off, many parents find themselves grappling with the daunting challenge of managing school fees.

For those facing financial constraints, the burden can be overwhelming.

However, there are proactive steps parents can take to ease the strain and ensure their child’s education remains a top priority.

The first step in addressing school fee struggles is to reach out to the school directly.

Many educational institutions understand the financial challenges families may face and are willing to provide support.

Arrange a meeting with school officials to discuss your situation openly and honestly.

Schools are often more than willing to work with parents to find viable solutions.

Communicate with School Administrators

Effective communication is key. Approach school administrators, including the principal or financial aid office, to discuss your concerns.

Share any changes in your financial situation that may impact your ability to meet payment obligations.

Schools appreciate transparency and may offer insights or alternative options to help alleviate the financial strain.

Inquire About Available Financial Aid Programs

Many schools have financial aid programs designed to assist families facing economic hardships.

Inquire about these programs and the eligibility criteria.

Schools may offer scholarships, grants, or tuition assistance that can significantly reduce the financial burden on parents.

Flexible Payment Options

If paying the entire school fee upfront is challenging, discuss flexible payment options with the school.

Some institutions may allow parents to pay fees in installments, making the financial commitment more manageable.

Be open about your limitations and work together to find a solution that accommodates both parties.

Negotiate a Payment Plan

Negotiation is a powerful tool.

Engage in a constructive dialogue with school authorities to negotiate a payment plan that aligns with your financial capabilities.

Emphasize your commitment to ensuring your child’s education remains uninterrupted while also meeting your financial obligations.

By proactively seeking assistance, communicating openly, exploring financial aid options, discussing flexible payment arrangements, and negotiating feasible plans, parents can navigate school fee struggles with greater ease.

Remember, schools are partners in your child’s education, and working together can lead to solutions that benefit everyone involved.

Read: Evaluating Your Finances Before Marriage

Supplementing Income: What Parents Can Do

In the face of escalating school fees, parents often find themselves grappling with financial challenges.

However, there are proactive steps they can take to alleviate the burden and provide their children with a quality education.

One promising avenue is to explore supplemental income sources.

Find Additional Sources of Income

Parents can broaden their financial horizons by identifying and tapping into additional income streams.

This could involve exploring investment opportunities, such as stocks or real estate, to generate passive income over time.

Diversifying income sources provides a safety net and helps mitigate the impact of unexpected financial hurdles.

Consider Part-Time Jobs or Freelance Work

Taking on part-time employment or engaging in freelance work can significantly bolster the family’s income.

This may involve pursuing opportunities in areas where the parent possesses expertise, such as consulting or freelance writing.

Online platforms offer a plethora of job opportunities, allowing parents to find flexible work arrangements that suit their schedules.

Monetize Existing Talents or Skills

Everyone possesses unique talents or skills that can be monetized.

Whether it’s photography, writing, graphic design, or crafting, turning hobbies into income-generating activities can make a considerable difference.

Parents can explore freelance platforms or local markets to showcase and sell their creations or services.

Start a Small Business Venture

Embarking on a small business venture can be a transformative way to supplement income.

This could range from starting an online store to offering a local service.

By leveraging their skills and knowledge, parents can create a sustainable source of income that not only supports their children’s education but also fosters a sense of entrepreneurial spirit.

Basically, while school fees may pose a significant challenge, parents can take proactive steps to ease the burden.

By strategically supplementing income through diverse channels, such as part-time jobs, freelancing, and small business ventures, parents can not only navigate current financial constraints but also build a more resilient and prosperous future for their families.

Cut back on expenses

In the face of school fee struggles, parents often find themselves grappling with financial challenges.

However, with strategic planning and a keen eye for budgeting, there are proactive steps parents can take to alleviate the burden.

In this section, we will explore practical measures to ease the financial strain, focusing on cutting back on expenses, analyzing spending habits, identifying non-essential expenses, reducing unnecessary costs, and exploring alternative options for necessities.

The first step towards financial relief is to cut back on unnecessary expenses.

Evaluate your monthly budget and identify areas where spending can be trimmed.

This might involve reevaluating subscription services, dining out less frequently, or finding cost-effective alternatives for everyday items.

Spending Habits

Take a closer look at your spending habits to identify patterns and potential areas for improvement.

Tracking expenses can reveal surprising insights into where your money goes each month.

Utilize budgeting tools or apps to streamline this process and gain a better understanding of your financial landscape.

Non-Essential Expenses

Distinguish between essential and non-essential expenses.

While some costs are unavoidable, others may be more flexible.

Consider temporarily cutting back on non-essential items until your financial situation stabilizes.

This might involve postponing vacations, limiting luxury purchases, or reevaluating entertainment expenses.

Reduce Unnecessary Costs

Once non-essential expenses are identified, take active steps to reduce or eliminate them.

Negotiate bills, look for discounts, and explore more cost-effective options for services.

Small adjustments can add up, contributing to significant savings over time.

Alternative Options for Necessities

When faced with rising costs for essential items, explore alternative options that are budget-friendly.

This could involve purchasing generic brands, taking advantage of discounts and sales, or considering second-hand options for certain items.

All in all, navigating school fee struggles requires a proactive and strategic approach.

By cutting back on expenses, analyzing spending habits, identifying non-essential expenses, reducing unnecessary costs, and exploring alternative options for necessities, parents can work towards achieving financial stability while ensuring their children’s educational needs are met.

Encouragement for open communication and financial literacy

Parents should create a safe space for their children to discuss financial matters openly.

It is important to cultivate an environment where children feel comfortable talking about money.

Financial literacy should also be emphasized. Parents can educate their children about the basics of managing money and the importance of budgeting.

School fees with children

Parents should involve their children in discussions about school fees.

This will help children understand the financial responsibilities associated with education.

Explaining the reasons behind school fees and the expenses incurred can help children comprehend the value they receive from their education.

Teach children the value of money

Parents can teach their children the value of money by giving them opportunities to earn and save.

Assigning household chores and providing a weekly allowance can be an effective way to instill financial responsibility.

Showcasing how money is earned through hard work can help children appreciate its value and make wiser spending choices.

Involve children in financial decision-making

When making financial decisions that affect the family, parents should involve their children.

This can include deciding on family activities or making purchases within a budget.

By involving children in decision-making, they can learn about prioritizing and making choices based on financial constraints.

Educate children about saving and budgeting

Teaching children the importance of saving and budgeting can help them become financially responsible adults.

Parents can introduce concepts such as setting financial goals and creating a savings plan.

Encouraging children to save a portion of their allowance or earnings can foster good saving habits from an early age.

Essengtially, parents can play a vital role in helping their children navigate school fee struggles.

Encouraging open communication, teaching financial literacy, and involving children in financial decision-making are key strategies.

By imparting the value of money and educating children about saving and budgeting, parents can equip their children with the necessary skills to manage school fees effectively.

Conclusion

In the relentless pursuit of providing quality education for our children, parents often find themselves entangled in the web of school fee struggles.

However, navigating this challenge requires a strategic approach and a resilient mindset.

As we conclude our exploration of ways to overcome school fee hurdles, let’s reflect on the key strategies and reinforce the importance of persistence.

We’ve delved into various strategies to alleviate the burden of school fees.

From budgeting and financial planning to exploring scholarship opportunities and negotiating with educational institutions, parents have a multitude of tools at their disposal.

Harnessing these strategies collectively can create a powerful arsenal against the challenges posed by escalating educational costs.

In the face of financial constraints, persistence becomes the cornerstone of success.

It’s crucial to remember that overcoming school fee struggles is not an overnight achievement.

Stay committed to the strategies outlined, be patient in your pursuit, and continue to explore innovative solutions.

Persistence is the key to unlocking the doors to a brighter educational future for your children.

To parents navigating the tumultuous waters of school fee challenges, remember that you are not alone.

Seek support from community resources, connect with other parents facing similar struggles, and share your experiences.

The strength of a community lies in its ability to support one another, and by fostering such connections, the journey becomes more manageable.