Introduction

In today’s consumerist society, personal finance has become crucial for maintaining financial stability and achieving long-term goals.

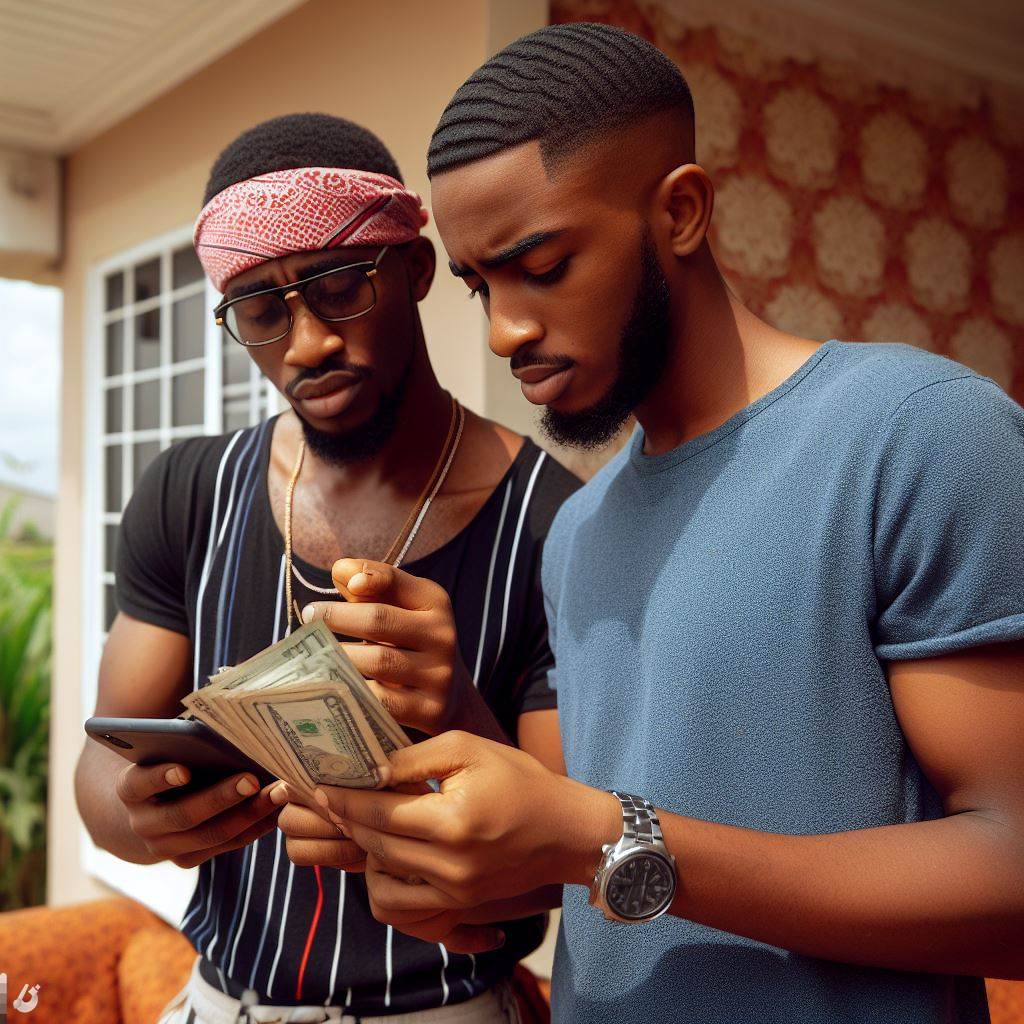

However, one often overlooked aspect of personal finance is the influence of friends on our financial decisions.

Managing personal finance allows individuals to have control over their money, enabling them to make informed choices and avoid unnecessary debt.

It helps in budgeting, saving, investing, and ensuring financial security for the future.

Friends play a significant role in shaping our financial behavior.

Peer pressure from friends can lead to impulsive buying decisions and overspending, often causing financial stress and instability.

Keeping up with social circles’ extravagant lifestyles can be tempting but detrimental in the long run.

Moreover, friends can indirectly influence our spending habits through their recommendations and preferences.

Constant exposure to extravagant activities, such as expensive vacations or dining out at high-end restaurants, can create a norm of overspending, making it harder to stick to a financial plan.

Additionally, friends may unintentionally discourage the importance of saving and investing by prioritizing immediate enjoyment.

Seeing friends splurging on luxury items and experiences can make us question and compromise our financial discipline.

To resist the influence of friends on personal finance, it is crucial to be aware of our own financial goals and priorities.

Building a strong sense of financial responsibility and creating a budget aligned with these objectives will help resist unnecessary spending influenced by peers.

In fact, personal finance is essential for achieving financial stability and reaching long-term goals.

However, being aware of the influence of friends on our financial decisions is equally important.

Your Personalized Financial Plan

Get expert financial advice tailored exclusively to your goals. Receive a custom roadmap in just 1-3 business days.

Get StartedBy staying true to our financial goals and priorities, we can resist peer pressure and maintain control over our finances.

Understanding the Pressure: Friends and Spending Habits

Friendship is a beautiful bond that enhances our lives in numerous ways.

Friends provide support, laughter, and a sense of belonging.

However, when it comes to spending habits, friends can also exert an unexpected influence on us.

Peer pressure and its impact on spending

- Our friends often play a significant role in shaping our spending behaviors.

- The desire to fit in and be accepted can lead us to spend money on things we don’t need.

- When we see our friends splurging on luxurious items, it creates a subconscious pressure to do the same.

- Peer pressure can make us feel inadequate if we can’t keep up with our friends’ spending habits.

- Being mindful of this pressure allows us to take control of our finances and make conscious decisions.

The need for financial independence

- Being financially independent provides a sense of freedom and security.

- Relying too heavily on friends for financial support can weaken our self-esteem and self-worth.

- Establishing a healthy balance between financial help and personal responsibility is crucial.

- It’s essential to set realistic financial goals and work towards achieving them independently.

- Financial independence also allows us to prioritize our needs and make responsible spending choices.

Recognizing unhealthy spending patterns influenced by friends

- Friends who constantly encourage impulsive purchases may not have our best interests at heart.

- We must be aware of our values and differentiate between needs and wants.

- Constantly mimicking our friends’ spending patterns can lead to financial turmoil.

- Taking the time to evaluate our own financial situation and priorities is crucial.

- Recognizing the negative impact of unhealthy spending patterns is the first step towards change.

In short, while friends are an essential part of our lives, it’s important to be cautious about the influence they can have on our spending habits.

By understanding peer pressure, striving for financial independence, and recognizing unhealthy spending patterns, we can resist the pressure to break the bank and make sound financial decisions.

Read: Affordable Birthday Ideas for Every Age in Nigeria

Assessing Your Financial Situation

Knowing your financial goals and priorities

Knowing your financial goals and priorities is crucial for managing your money effectively.

This step is the foundation of your financial success and will help you resist the temptations that come from friends who want to spend big.

Start by identifying your short-term and long-term financial goals.

This could include saving for a vacation, buying a car, paying off debt, or planning for retirement.

Knowing exactly what you want to achieve financially will give you the motivation to stay on track and resist unnecessary spending.

Evaluating your income and expenses

Next, evaluate your current income and expenses.

Take a close look at your monthly income, including your salary, bonuses, and any other sources of income.

Unlock a Debt-Free Future with Our Unique Strategies

Imagine a life unburdened by debt—a reality we help you visualize and achieve. We offer personalized strategies tailored to your unique situation, guiding you step-by-step toward financial freedom.

Start TodaySubtract your fixed expenses such as rent, utilities, and insurance. Then, analyze your discretionary spending like dining out, entertainment, and shopping.

Identifying areas where you overspend due to friends’ influence

Identifying areas where you overspend due to friends’ influence is crucial.

Friends can have a significant impact on your finances, especially if they tend to spend recklessly.

Take a moment to look at your spending patterns when you are with friends and identify any areas where you may be giving in to peer pressure.

Here are some common areas where friends’ influence can lead to overspending:

Dining out

Eating at expensive restaurants or ordering lavish meals can quickly drain your bank account.

Suggest alternatives like cooking at home or finding budget-friendly restaurants to enjoy quality time with friends without breaking the bank.

Shopping

Friends might tempt you into shopping sprees, buying unnecessary items, or splurging on designer brands.

Remember your financial goals and prioritize needs over wants.

It’s okay to say no or suggest alternative activities that don’t involve spending money.

Travel

While traveling with friends can be an unforgettable experience, it can also be costly.

Evaluate your travel plans and set a budget that aligns with your financial goals.

Consider cheaper accommodation options, transportation, and activities that still allow you to have a fantastic time without overspending.

Nightlife

Going out for drinks or partying can quickly become expensive.

Unlock Untapped Nigerian Wealth with Our Expert Advice

Imagine accessing investment opportunities others overlook—stocks, bonds, real estate, small businesses tailored to you. We offer personalized advice you won't find elsewhere, guiding you to financial success.

Unlock WealthSet a limit on how much you are willing to spend on a night out and stick to it.

Look for happy hour deals or suggest alternative activities that don’t revolve solely around spending money.

Resisting the influence of friends who want to spend extravagantly can be challenging, but it is essential for your financial well-being.

Keep these tips in mind to stay on track

Communicate

Talk openly with your friends about your financial goals and limitations.

True friends will respect your choices and support you in staying within your budget.

Find like-minded friends

Surround yourself with people who share similar financial values.

Having friends who prioritize saving and financial responsibility will make it easier for you to resist overspending.

Be confident in saying no

Remember that it’s okay to decline expensive invitations or suggest alternative plans.

Your financial stability should be your top priority.

Stick to your budget

Create a realistic budget that considers your financial goals and track your expenses diligently.

This will give you a clear picture of where your money is going and help you identify areas where you need to cut back.

Taking control of your financial situation is empowering.

By assessing your financial goals, evaluating your income and expenses, and identifying areas where friends’ influence can lead to overspending, you can resist the temptation to break the bank.

Stay focused on your goals and surround yourself with supportive friends who encourage your financial success.

Remember, it’s your money and your future at stake.

Read: Moving Costs: A Nigerian’s Guide to Budgeting

Setting Boundaries and Communicating

Understanding the Importance of Setting Financial Limits

- Financial limits help you stay within budget and avoid unnecessary debt.

- Setting boundaries ensures that your financial well-being is not compromised.

- It allows you to prioritize your needs and save for future goals.

- By setting limits, you gain control over your finances and make informed decisions.

- Financial limits also promote responsible behavior and discourage impulsive spending.

Communicating Your Financial Goals and Limits to Friends

- Openly discuss your financial goals and limit with your friends.

- Explain the importance of sticking to your budget and respecting your boundaries.

- Be honest about your financial situation and any constraints you may have.

- Encourage your friends to support and respect your financial choices.

- Let them know that your friendship is not based on money and material things.

Being Assertive and Saying No to Excessive Spending

- Practice saying no to unnecessary expenses that don’t align with your financial goals.

- Politely decline invitations for expensive outings or activities that you can’t afford.

- Be firm and assertive in your decision to stick to your financial limits.

- Suggest alternative, budget-friendly activities that still allow you to spend quality time with friends.

- Remember, it’s okay to prioritize your financial stability over temporary indulgences.

Setting boundaries and communicating your financial goals and limits to friends is crucial for maintaining your financial well-being.

By understanding the importance of financial limits, you can make informed decisions, prioritize your needs, and save for the future.

Openly discussing your financial situation with friends allows them to support and respect your choices.

Being assertive and saying no to excessive spending reinforces your commitment to your financial goals.

Remember, it’s okay to prioritize your financial stability over temporary pleasures.

Read: Budgeting for Your New Life Abroad from Nigeria

Finding Alternative Ways to Socialize

In this age of materialism and consumerism, it’s easy to get caught up in the rat race of spending money to keep up with friends.

However, it’s essential to remember that true friendships are not based on how much money you spend together but rather on the quality of time you share.

Here are some alternative ways to socialize without breaking the bank:

Exploring inexpensive or free activities with friends

- Organize a picnic in the park: Enjoy a sunny day with your friends by packing some homemade snacks and beverages and head out to a nearby park. It’s a great opportunity to relax, have meaningful conversations, and enjoy the beauty of nature together.

- Plan a game night: Invite your friends over for a game night filled with laughter, friendly competition, and good old-fashioned fun. Pull out board games, card games, or even create your own interactive challenges. It’s a cost-effective way to have a blast without requiring much money.

- Take advantage of community events: Many communities host free or low-cost events, such as outdoor concerts, art exhibitions, or festivals. Check out your local community calendar to see what exciting activities are happening nearby. Attending these events with your friends will not only save money but also expose you to new experiences.

Focusing on deeper connections and quality time rather than materialistic pursuits

- Organize a book club or movie night: Instead of going out to expensive restaurants, suggest hosting a book club or movie night at home. Choose a thought-provoking book or a critically acclaimed movie and engage in meaningful discussions afterward. This way, you not only save money but also nurture your intellect and forge deeper connections with your friends.

- Plan a DIY project: Get creative and plan a do-it-yourself project with your friends. It could be anything from repurposing old furniture, designing your own clothes, or creating unique artwork. Not only will you save money by avoiding retail prices, but you’ll also have a sense of accomplishment by creating something together.

- Engage in volunteering activities: Spend your time making a positive impact on the community by volunteering with your friends. Whether it’s helping out at a local food bank, cleaning up a beach or park, or organizing a charity event, giving back to society will strengthen your bond with friends while being economically friendly.

Encouragement for friends to join cost-conscious activities

- Share your ideas: If you have discovered inexpensive or free activities that you enjoy, share them with your friends. They may not be aware of such options and would appreciate your suggestions. Plus, by inviting them to cost-conscious activities, you create opportunities for everyone to save money and have a great time together.

- Plan budget-friendly outings: When suggesting outings, consider your friends’ financial situations. Opt for affordable options like potluck dinners, hiking trips, or hosting a movie marathon at home. By being mindful of their budgets, you create a comfortable environment where no one feels excluded due to financial constraints.

- Encourage open communication: Sometimes, friends may hesitate to express their concerns about expensive outings. Create a safe space for open communication where they feel comfortable discussing their financial limitations. By fostering an environment of understanding, you can collectively find alternative ways to socialize that accommodate everyone’s needs.

In essence, true friendships are about the quality of time spent together, not the amount of money spent.

By exploring inexpensive or free activities, focusing on deeper connections, and encouraging cost-conscious activities, you can resist succumbing to materialistic pursuits.

Remember, the memories you create and the connections you foster are far more valuable than any material possession.

Read: Nigeria to UK: Budgeting Your Move Right

Creating a Budget and Saving Plan

In a world that often pushes us to spend beyond our means, it’s crucial to establish a financial fortress that shields us from unnecessary expenses.

Friends may tempt us to splurge, but the key is to resist the pressure without sacrificing social connections.

Let’s delve into the first step of financial resilience: creating a budget and saving plan.

Establishing a Realistic Budget

The cornerstone of financial stability is a well-crafted budget.

Start by evaluating your monthly income and fixed expenses.

Identify necessities like rent, utilities, and groceries, then allocate funds for discretionary spending.

Be honest with yourself about your spending habits, and set realistic limits for entertainment and non-essential purchases.

This step not only ensures you live within your means but also sets the stage for disciplined financial habits.

Allocating Funds for Savings and Emergency Fund

Once your budget is in place, prioritize savings.

Allocate a specific percentage of your income to a dedicated savings account.

This not only safeguards your financial future but also provides a safety net during unforeseen circumstances.

Establish an emergency fund equivalent to three to six months’ worth of living expenses.

Having this buffer protects you from the unexpected, enabling you to resist financial pressures from friends without compromising your financial security.

Utilizing Budgeting Apps and Tools

Technology can be a powerful ally in the quest for financial resilience.

Numerous budgeting apps and tools are designed to simplify tracking expenses and monitoring savings progress.

Take advantage of these resources to gain real-time insights into your financial health.

Set alerts for overspending, analyze your spending patterns, and adjust your budget as needed.

These tools not only streamline the budgeting process but also empower you to make informed financial decisions, resisting the influence of extravagant peer spending.

In a nutshell, mastering the art of budgeting and saving is the key to resisting financial pressures from friends.

By creating a realistic budget, prioritizing savings, and leveraging technology, you build a robust financial foundation that allows you to say ‘no’ to overspending while maintaining meaningful connections.

Remember, financial resilience is not about deprivation but about making intentional choices that align with your long-term goals.

Seeking Support from Like-Minded Individuals

When it comes to managing our finances, we often find ourselves facing challenges that can be influenced by our friends and peers.

Whether it’s going out for expensive dinners, shopping sprees, or lavish vacations, our social circles can have a significant impact on our financial well-being.

In order to resist these financial pressures and make better money decisions, it’s important to seek support from like-minded individuals, join personal finance communities, share experiences, seek advice, and surround ourselves with friends who prioritize financial well-being.

One effective way to resist friends’ financial influence is by seeking support from like-minded individuals who share similar financial goals and values.

By surrounding ourselves with people who prioritize saving, budgeting, and financial stability, we can create a positive environment that encourages us to make responsible financial choices.

Joining Online Personal Finance Communities

Another great strategy is to join online personal finance communities where we can connect with individuals facing similar financial situations.

These communities provide a platform to share experiences, seek advice, and learn valuable tips and techniques to better manage our finances.

Sharing Experiences and Seeking Advice

By sharing our experiences and seeking advice from others who have faced similar financial challenges, we can gain valuable insights and learn from their mistakes.

This can greatly contribute to our own financial growth and help us resist the temptations brought on by our friends and peers.

Surrounding Yourself with Friends Who Prioritize Financial Well-being

Choosing our friends wisely is instrumental in maintaining a healthy financial lifestyle.

Surrounding ourselves with friends who prioritize their financial well-being and have similar attitudes towards money can help us resist the pressure to overspend and make impulsive financial decisions.

It’s essential to be mindful of the influence our friends and peers can have on our spending habits and financial choices.

By seeking support from like-minded individuals, joining online personal finance communities, sharing experiences, seeking advice, and surrounding ourselves with friends who prioritize financial well-being, we can resist the pressure to break the bank.

Remember, making responsible financial decisions can not only lead to long-term financial security but also positively impact our overall well-being and future goals.

Conclusion

Taking control of your personal finance is crucial in order to achieve financial independence and build a strong financial foundation for a secure future.

One significant step towards this involves resisting the influence of friends when it comes to spending and financial decisions.

Friends can often have a significant impact on our spending habits.

It’s easy to get caught up in the desire to keep up with the latest trends or to participate in expensive activities just because our friends are doing so.

However, succumbing to this peer pressure can lead to financial strain and potentially, breaking the bank.

Resisting the influence of friends may not be easy, but it is necessary.

It requires understanding your own financial goals and priorities, and being willing to make decisions that align with them, even if it means saying no to certain social activities or purchases.

It may also involve finding new ways to socialize that are more budget-friendly.

By taking control of your personal finance and resisting the influence of friends, you can achieve financial independence.

This means being able to make financial choices based on what is best for you, rather than feeling pressured to keep up with others.

It also means building a strong financial foundation for a secure future, with savings, investments, and a healthy financial situation.

Remember, financial independence is about taking charge of your own financial well-being.

While it’s important to cherish the bonds of friendship, it’s equally critical to prioritize your long-term financial stability.

So, resist the urge to break the bank and focus on building a secure and prosperous future for yourself.