Understanding the Basics of Financial Literacy

Definition and Core Concepts

Financial literacy means having the knowledge to manage money effectively.

It includes skills such as budgeting.

It also covers saving and investing wisely.

Moreover, it covers understanding credit.

It includes loans and interest rates.

People who are financially literate make informed decisions about their finances.

This knowledge helps prevent debt accumulation.

It encourages financial growth.

Importance in Everyday Life

Financial literacy plays a crucial role in managing daily expenses.

For example, it helps families plan for future needs like education.

It also helps plan for healthcare.

Additionally, it supports better handling of emergencies through savings.

Workers who understand their salaries and benefits can optimize their income.

Consequently, they can avoid common financial pitfalls in Nigeria.

Impact on Individuals and Communities

Financial education empowers individuals like Adaobi Okafor to control their economic futures.

Your Personalized Financial Plan

Get expert financial advice tailored exclusively to your goals. Receive a custom roadmap in just 1-3 business days.

Get StartedBusinesses led by entrepreneurs such as Emeka Udo can thrive.

They succeed by making better financial decisions.

Furthermore, communities grow stronger when residents manage resources well.

These skills contribute to reducing poverty.

They improve quality of life.

Therefore, promoting financial literacy is vital for Nigeria’s development.

The Current State of Financial Literacy in Nigeria and Its Impact on Economic Development

Overview of Financial Literacy Levels in Nigeria

Financial literacy remains a significant challenge across many Nigerian communities.

According to recent surveys, less than half of adults understand basic financial concepts.

Many individuals lack knowledge of savings, investments, and credit management.

This gap affects people from urban and rural areas alike.

Rural areas face greater obstacles in financial literacy.

For instance, in Enugu State, many residents struggle with budgeting their limited incomes effectively.

Insufficient financial education leads to poor money management decisions.

Factors Contributing to Low Financial Literacy

Several factors hinder the widespread adoption of financial literacy in Nigeria.

Unlock a Debt-Free Future with Our Unique Strategies

Imagine a life unburdened by debt—a reality we help you visualize and achieve. We offer personalized strategies tailored to your unique situation, guiding you step-by-step toward financial freedom.

Start TodayEducational curricula often omit practical money skills needed for everyday life.

A lack of access to formal financial services limits experiential learning opportunities.

Cultural attitudes sometimes discourage open discussions about money matters.

In some northern Nigerian communities, financial topics remain taboo within households.

Economic inequalities exacerbate knowledge gaps across different social classes.

Economic Impacts of Financial Literacy Deficiency

Low financial literacy affects Nigeria’s economic growth in multiple ways.

Individuals often accumulate debts due to poor understanding of credit terms.

Small and medium-sized enterprises face cash flow mismanagement causing business failures.

Insufficient knowledge about investment reduces participation in capital markets.

These trends hinder wealth creation and deepen poverty cycles within many regions.

National productivity suffers when people cannot optimize their financial resources.

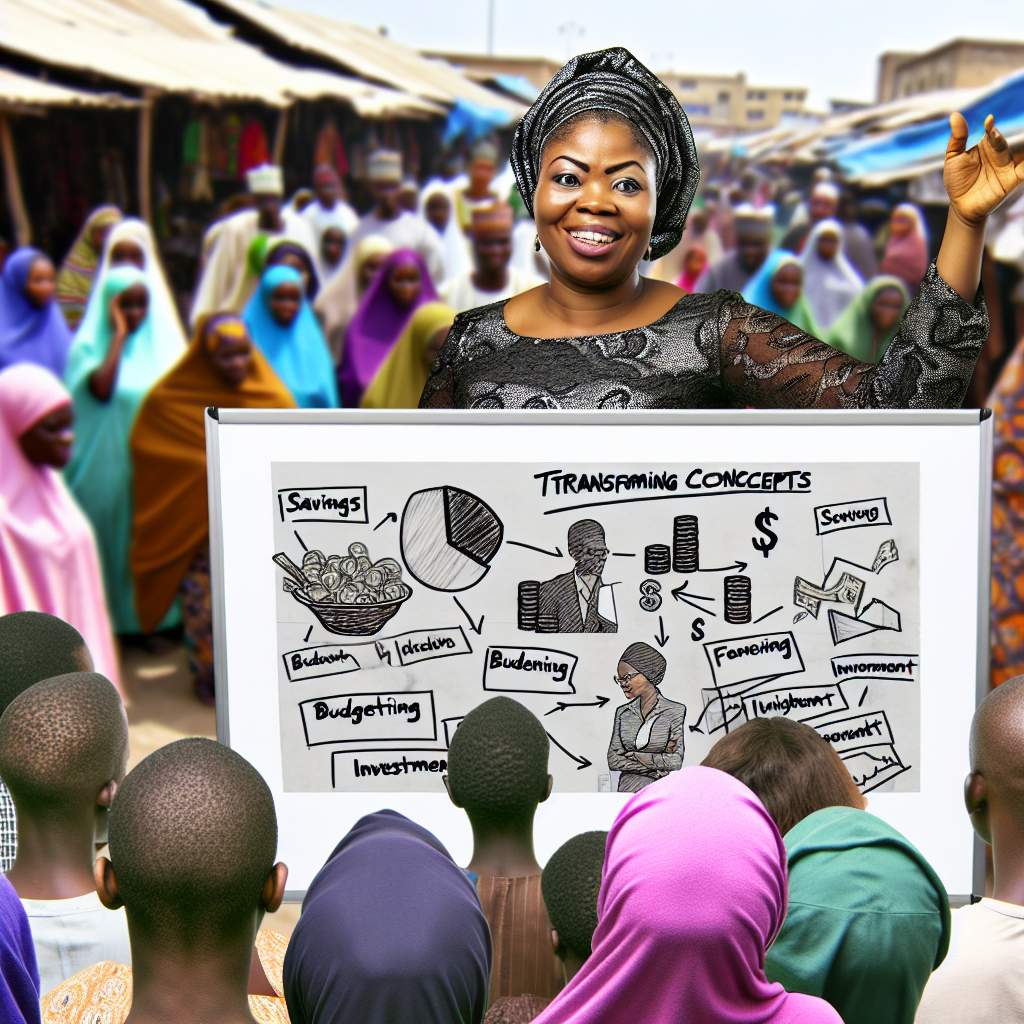

Benefits of Enhancing Financial Literacy

Enhancing financial education can transform households and communities.

Individuals become empowered to save, invest, and plan for the future effectively.

Higher financial awareness encourages entrepreneurship and job creation across sectors.

Unlock Untapped Nigerian Wealth with Our Expert Advice

Imagine accessing investment opportunities others overlook—stocks, bonds, real estate, small businesses tailored to you. We offer personalized advice you won't find elsewhere, guiding you to financial success.

Unlock WealthBanks like Fidelity Bank and Access Bank have launched literacy programs nationwide.

These initiatives improve people’s ability to use digital banking and financial products securely.

A financially savvy population supports sustainable economic development.

Current Efforts to Promote Financial Literacy in Nigeria

Government agencies and NGOs actively promote financial literacy across the country.

The Central Bank of Nigeria runs campaigns to educate citizens on financial services.

Nonprofits like the Prosperity Foundation provide workshops targeting youth and women entrepreneurs.

Tech startups such as FinanceMate Nigeria offer mobile apps for budget tracking.

These efforts help close the knowledge gap by delivering practical tools and training.

Continued collaboration among stakeholders remains vital to expanding these programs’ reach.

How Financial Literacy Promotes Better Budgeting and Personal Money Management

Understanding the Importance of Budgeting

Financial literacy teaches individuals the value of budgeting in daily life.

With knowledge, Chinedu manages his expenses more effectively every month.

Moreover, budgeting helps prevent overspending and reduces financial stress.

Therefore, Lagos-based entrepreneur Adaora uses budgets to allocate funds wisely.

Consequently, she saves more for her family and investments.

Setting Realistic Financial Goals

Financial literacy encourages setting achievable short-term and long-term goals.

Uche plans his finances with clear objectives, promoting disciplined spending.

Furthermore, having goals helps prioritize essential expenses over wants.

For example, Ifeoma saves regularly for her children’s education.

Thus, she ensures future financial security through consistent effort.

Tracking Income and Expenses

Financially educated individuals consistently monitor their cash flow.

For instance, Emeka uses simple tools to record daily expenses accurately.

This habit reveals spending patterns and identifies unnecessary costs.

Subsequently, it empowers her to adjust habits and improve savings.

Implementing Practical Money Management Techniques

People apply various strategies to maximize the usefulness of their income.

One method involves separating funds for bills, savings, and leisure.

Chika schedules automatic transfers to savings accounts monthly.

This automation reduces the temptation to spend funds prematurely.

Additionally, it builds emergency funds to cope with unforeseen expenses.

Using Financial Tools and Resources

Financial literacy exposes individuals to useful budgeting apps and services.

For example, Nnamdi relies on mobile apps to set spending limits.

These tools offer real-time alerts that prevent overspending impulsively.

Moreover, they provide visual insights into financial health and progress.

Encouraging Responsible Credit Use

Knowing how credit works helps avoid debt accumulation and interest traps.

Financially aware Nigerians, like Bola, use credit cards judiciously.

She pays balances promptly to maintain good credit scores.

Such habits allow access to better loans when needed.

Building Confidence and Reducing Financial Anxiety

Confidence in money management grows as individuals master financial skills.

For example, Tolani feels secure making informed financial decisions.

This reduces anxiety about unexpected bills or economic downturns.

Ultimately, financial literacy fosters peace of mind and stability.

You Might Also Like: How Financial Literacy Reduces Poverty in Nigerian Communities

The Role of Financial Education in Reducing Debt and Encouraging Savings

Empowering Individuals to Manage Debt Effectively

Financial education helps Nigerians understand the dangers of excessive debt.

It teaches practical strategies for avoiding high-interest loans.

Moreover, it encourages responsible borrowing habits among families and youth.

By learning debt management skills, individuals can prioritize repayments effectively.

Financial literacy also enables people to recognize predatory lending schemes quickly.

Consequently, many avoid falling into debt traps and spirals.

Building a Culture of Savings in Communities

Financial education highlights the importance of regular savings for future needs.

It introduces methods such as budgeting to allocate income wisely.

Additionally, programs promote the benefits of emergency funds and long-term savings.

Training often includes information about available local savings groups and banks.

Nigerians gain confidence in setting achievable savings goals.

Communities that embrace financial skills show improved economic resilience.

Benefits of Financial Literacy for Nigerian Families

Better financial education reduces anxiety related to money management.

Families learn to balance expenses, minimizing unnecessary debts.

Children exposed to financial principles adopt healthy money habits.

Money managers like Tunde Alabi have witnessed increased savings in households.

Educational initiatives by organizations such as Harmony Financial Institute empower hundreds daily.

Ultimately, these efforts improve overall economic well-being across Nigeria.

Strategies to Promote Financial Education Nationwide

Government agencies collaborate with private sectors to offer free training sessions.

Schools integrate financial literacy into core curricula for youth.

Local banks design user-friendly workshops tailored to community needs.

Nonprofits organize campaigns to demystify savings and debt management.

Innovative digital platforms provide accessible financial tools and resources.

These strategies foster sustainable financial habits throughout Nigeria’s population.

Uncover the Details: How to Teach Financial Literacy to the Next Generation

Empowering Nigerian Youths through Financial Literacy

Building a Foundation for Wealth

Financial literacy equips Nigerian youths with essential money management skills.

It enables them to make informed decisions about saving.

It also helps with investing and spending wisely.

Consequently, youths can avoid debt traps.

They also build sustainable financial habits.

For example, Segun Adeyemi, a Lagos entrepreneur, began wealth-building through basic budgeting techniques.

Moreover, understanding financial principles helps youths plan for long-term goals like home ownership.

Fostering Entrepreneurship and Innovation

Financial literacy sparks entrepreneurial spirit among Nigerian youths.

It allows aspiring business owners to create realistic budgets.

It also helps manage cash flow efficiently.

Therefore, young entrepreneurs can reduce the risk of business failure.

For instance, Chiamaka Umeh successfully launched her tech startup by mastering financial statements.

Additionally, financial knowledge empowers youths to seek funding from banks or investors confidently.

Accessing Financial Services with Confidence

Many Nigerian youths lack confidence in using banking and financial services.

Financial literacy demystifies banking products like loans, savings accounts, and insurance.

Thus, youths like Emeka Nnaji can leverage microfinance loans to expand their small businesses.

It also encourages responsible borrowing and timely repayment habits.

Consequently, the youth population gains better access to formal financial institutions.

Strengthening Economic Resilience

Youth financial literacy contributes to economic stability at the community level.

Informed financial decisions reduce vulnerability to financial shocks and crises.

For example, Mariam Bello built an emergency fund after attending a financial literacy workshop.

Furthermore, wealth creation by youths creates jobs and stimulates local economies.

Therefore, empowering youths financially drives Nigeria’s broader economic growth and prosperity.

Promoting Financial Education Programs

Governments and NGOs are increasingly prioritizing youth financial education.

Organizations like the Nigerian Youth Finance Initiative offer tailored workshops and resources.

Similarly, schools integrate financial literacy into curricula for secondary and tertiary students.

This approach ensures continuous learning and practical application of financial concepts.

As a result, more Nigerian youths gain the tools needed to succeed financially.

Practical Steps for Youths to Improve Financial Literacy

Youths should actively seek financial knowledge through books, courses, and online content.

They can join community finance clubs to share experiences and learn collaboratively.

Additionally, using budgeting apps like Cowrywise helps track income and expenses effectively.

Youths must practice disciplined saving, even with small amounts regularly.

Finally, consulting financial advisors such as Tunde Afolayan can provide personalized guidance.

Discover More: The Role of Digital Tools in Financial Literacy Education

The Connection Between Financial Literacy and Improved Access to Credit and Banking Services

Empowering Individuals to Navigate Financial Systems

Financial literacy equips individuals with the knowledge to understand banking products.

Consequently, they can compare loan options and select suitable credit facilities.

For example, Funmi, a small business owner in Lagos, learned how to assess interest rates effectively.

Therefore, she secured a microloan from Unity Microfinance Bank to expand her textile business.

Moreover, understanding credit scores helps Nigerians maintain their financial reputation.

This knowledge improves their eligibility for future loans and other banking services.

Strengthening Trust in Formal Financial Institutions

Many Nigerians rely on informal lending due to mistrust of banking institutions.

However, financial education reduces fear and misconceptions about banks.

As a result, more people open accounts at banks like Keystone Bank and Polaris Bank.

Opening an account enables easier access to savings and credit products.

In addition, formal banking facilitates participation in government financial programs.

Musa, a farmer from Kaduna, accessed a government subsidy after registering his bank account.

Enhancing Credit Access Through Better Financial Practices

Financial literacy promotes budgeting skills that improve repayment ability.

Lenders, such as Sterling Bank, consider repayment history when granting credit.

Thus, clients who manage finances well build stronger creditworthiness.

This increase in credit access allows entrepreneurs to invest in new ventures.

For instance, Chidinma used her credit knowledge to obtain a loan for her catering startup.

Additionally, financial savvy helps borrowers avoid common debt pitfalls.

Benefits of Financial Literacy for Banking Inclusion

- Improved knowledge leads to increased usage of bank accounts and mobile money.

- Greater use of digital banking helps reduce transaction costs and time.

- Access to insurance and retirement products improves financial security.

- Enhanced financial awareness supports economic empowerment and poverty reduction.

Collins, a tech entrepreneur in Abuja, leveraged digital banking to streamline payments.

Ultimately, financial literacy bridges the gap between underserved communities and financial services.

Gain More Insights: Financial Literacy 101: Key Concepts Nigerians Should Master by 2024

How Financial Literacy Helps Nigerians Navigate Inflation and Economic Instability

Understanding Inflation and Its Impact

Inflation reduces the value of money over time.

Consequently, everyday goods and services become more expensive.

For many Nigerians, this leads to decreased purchasing power.

However, financial literacy empowers individuals to recognize inflation’s effects.

By understanding inflation, they can prepare and adjust their finances accordingly.

Building Strong Budgeting Skills

Effective budgeting helps Nigerians manage limited resources during economic instability.

By tracking income and expenses, they avoid unnecessary spending.

Moreover, budgeting prioritizes essential needs over wants.

This approach prevents overspending even when prices rise sharply.

Financial education teaches practical budgeting methods for diverse income levels.

Utilizing Savings and Investments Wisely

Financial literacy encourages saving consistently despite economic challenges.

Savings provide a safety net against unexpected expenses or job loss.

Additionally, knowledgeable Nigerians explore investment options to grow their funds.

Investing in inflation-resistant assets helps preserve long-term value.

Institutions like Heritage Federal Bank offer educational workshops on smart investments.

Accessing and Managing Credit Responsibly

Understanding credit prevents falling into debt traps during tough times.

Informed borrowers at Unity Trust Bank know to avoid predatory loans.

Financial literacy teaches how to compare interest rates and loan terms.

Responsible credit use builds trust and creditworthiness for future borrowing.

It also supports business growth and personal financial stability.

Developing Income Diversification Strategies

Relying on one income source increases vulnerability during economic instability.

Financial education promotes gaining new skills and side income opportunities.

For example, Chinedu Okafor started small-scale catering alongside his main job.

Income diversification cushions families from inflation and unemployment risks.

It also fosters entrepreneurship and local economic development.

Leveraging Community-Based Financial Education

Local initiatives improve financial knowledge within Nigerian communities.

Groups like Lagos Finance Forum host seminars on inflation and money management.

These programs encourage peer learning and practical application.

Community efforts increase access to financial tools for underserved populations.

Ultimately, they build resilience against economic shocks nationwide.

Government Initiatives to Promote Financial Literacy

National Financial Inclusion Strategy

The Central Bank of Nigeria leads the National Financial Inclusion Strategy.

It aims to increase access to financial services nationwide.

Consequently, it promotes financial education to empower Nigerians.

The strategy targets underserved groups, including women and youth.

It collaborates with banks and telecommunication companies for outreach.

In addition, the government funds financial literacy programs across states.

Partnerships with Educational Institutions

The Federal Ministry of Education integrates financial literacy into curricula.

It collaborates with universities and secondary schools for awareness workshops.

For example, Lagos State University runs programs teaching budgeting and savings.

Furthermore, training teachers ensures sustainable delivery of financial knowledge.

These efforts equip students with practical money management skills early on.

Regulatory Support and Consumer Protection

The Securities and Exchange Commission organizes public seminars on investments.

Similarly, the Nigerian Deposit Insurance Corporation educates on safe banking practices.

Together, these agencies protect consumers from financial fraud.

They also produce accessible guides on understanding financial products.

Thus, they build confidence in formal financial institutions.

Private Sector Contributions to Financial Literacy

Banking Industry Outreach Programs

Guaranty Trust Bank hosts financial literacy workshops nationwide.

These sessions focus on saving, budgeting, and digital banking tools.

Zenith Bank supports mobile apps designed to teach financial concepts interactively.

Consequently, they engage young people and entrepreneurs effectively.

Private banks often partner with NGOs to widen their educational impact.

Technology Companies and Fintech Innovations

Flutterwave and Paystack develop platforms that encourage financial learning.

They provide user-friendly interfaces for managing finances securely.

Additionally, some fintech firms offer tutorials on investing and credit management.

These tools make financial literacy accessible even in remote communities.

Moreover, digital campaigns raise awareness about prudent money habits.

Non-Governmental Organizations and Civil Society Efforts

Organizations like Financial Literacy Network Nigeria run grassroot programs.

They deliver workshops in local languages tailored to community needs.

The Nigerian Economic Summit Group also advocates for policy reforms supporting education.

Through public-private partnerships, NGOs expand financial literacy reach.

Ultimately, these groups empower citizens to make informed economic decisions.

The Impact of Financial Literacy on Family Welfare and Long-Term Financial Planning

Enhancing Family Welfare through Financial Knowledge

Financial literacy empowers families to make informed money decisions every day.

As a result, families like the Ojos gain control over their household budgets effectively.

With better financial knowledge, parents prioritize essential expenses over impulsive spending.

Consequently, children grow up in stable environments with improved access to education.

Moreover, financial literacy reduces stress that results from money mismanagement within homes.

Families begin to save consistently, creating a safety net for emergencies and unforeseen events.

Financial skills also encourage healthier communication among family members about money matters.

This openness strengthens relationships and ensures everyone understands shared financial goals.

Building Foundations for Long-Term Financial Planning

Understanding money management inspires individuals like Chinedu Okoro to plan for the future confidently.

Firstly, financial literacy teaches the importance of setting realistic and achievable financial goals.

Next, it highlights the value of investments and diversifying income sources for security.

Financially educated Nigerians recognize the advantages of retirement savings and insurance policies.

Such planning shields families from economic shocks and preserves wealth over generations.

Furthermore, it enables entrepreneurs to grow businesses sustainably, as seen with Funmi Adewale’s catering firm.

This foresight ensures steady income streams and progression beyond immediate needs.

Practical Ways Financial Literacy Transforms Lives

Many gain the ability to avoid predatory loans and high-interest debts by understanding credit terms.

Instead, they seek affordable and responsible borrowing options aligned with their repayment capacities.

Also, better budgeting tools help families allocate money efficiently, ensuring bills get paid on time.

Financial literacy fosters habits like tracking expenses and revisiting budgets for continuous improvement.

Communities benefit as more people participate in formal banking and financial services.

Local banks, like Heritage Bank in Abuja, report increased customer engagement thanks to financial education programs.

In the end, empowered individuals contribute to economic growth and greater financial inclusion nationwide.

Using Digital Financial Tools and Technology to Enhance Financial Knowledge and Inclusion

Expanding Access through Mobile Banking

Mobile banking revolutionizes financial access across Nigeria.

It allows millions to perform transactions without physical banks.

This technology eliminates travel costs and reduces time spent accessing services.

Consequently, more people gain confidence in managing their finances electronically.

Startups like Paga and Kuda Bank lead the way with user-friendly apps.

Empowering with Financial Education Apps

Digital platforms offer tailored financial literacy lessons for Nigerians.

For example, apps like MoneySmart Nigeria combine education with practical tools.

Users learn budgeting, saving, and investing methods interactively.

Therefore, individuals build stronger money management habits at their own pace.

Moreover, gamified experiences encourage continuous engagement and knowledge retention.

Facilitating Microfinance and Peer-to-Peer Lending

Technology enables microloans to underserved small-business owners.

Platforms such as FarmCrowdy connect farmers directly to investors.

This approach boosts entrepreneurship and local economic growth efficiently.

Importantly, digital records improve credit scoring and loan access over time.

Thus, technology nurtures a more inclusive financial ecosystem across Nigeria.

Leveraging Social Media for Financial Awareness

Social media channels spread financial tips widely and rapidly.

Influencers like Chinedu Eze educate followers on savings and investment.

These platforms foster community discussions and peer support.

Additionally, interactive webinars and live sessions demystify complex financial topics.

Consequently, social media complements formal education efforts effectively.

Enhancing Security and Trust with Fintech Innovations

Advanced security features build trust in digital financial services.

Biometric verification and encryption protect user data and transactions.

Companies like Paystack ensure seamless and secure payment processing.

Therefore, users feel safer adopting new financial technologies.

This trust encourages wider use and deeper financial inclusion nationally.

Additional Resources

Making Finance Work for Women for 45 Years | Martha Ibrahim …

Transforming Lives: Digital Skills for Girls and Women in Northern …