Introduction

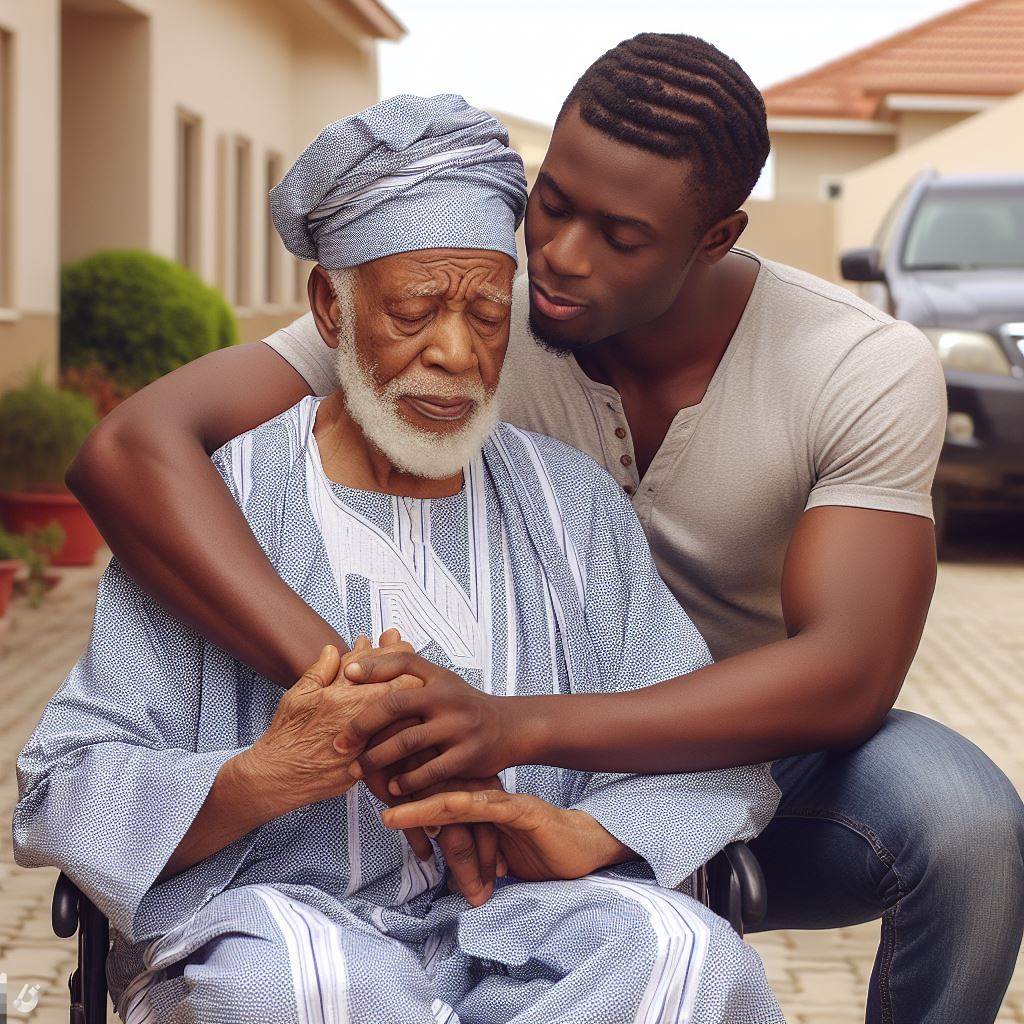

Picture this: parental illness, an unforeseen tempest that ruthlessly disrupts the tranquility of financial stability.

Bills surge like tidal waves, savings dwindle to mere drops, and the stress barometer skyrockets, underscoring the critical need for adept financial survival strategies.

In the unfolding sections of this blog post, our mission is unequivocal: to empower you with a comprehensive set of practical, hands-on tips for skillfully navigating the tumultuous waters of parental illness.

Imagine this as your compass, guiding you through the financial storm, helping you not only weather it but emerge stronger on the other side.

The purpose of this blog extends beyond merely acknowledging the challenges posed by parental illness.

It’s a beacon of practical wisdom, providing a roadmap for not just financial survival but a strategic approach to emerge resilient.

As we delve into the depths of this topic, envision equipping yourself with a robust financial toolkit that not only shields against the immediate impact but fosters lasting financial security.

Brace yourself for insights that transcend the ordinary—strategies that aren’t just theoretical but actionable, ensuring you’re not just a passive observer but an active participant in your financial resilience.

This journey is about more than survival; it’s about thriving amidst adversity, turning the challenges posed by parental illness into stepping stones towards a financially secure future.

Get ready to embark on this empowering voyage towards financial stability.

Understanding the Challenges

Challenges that arise when a parent falls ill

- Medical expenses and healthcare costs: When a parent falls ill, the family often faces the burden of high medical expenses and healthcare costs.

These can quickly deplete savings and put a strain on finances. - Reduced income or loss of income: Illness can lead to a reduced income or even loss of income if the parent is unable to work.

This can cause financial instability and make it difficult to cover daily expenses. - Increased caregiving responsibilities: A parent’s illness may require additional caregiving responsibilities for other family members.

This can result in loss of income as well as added expenses for hiring outside help or modifying living arrangements.

Importance of being prepared and proactive in managing finances during this time

During such challenging times, it is crucial to be prepared and proactive in managing finances. Here are some tips to help navigate this difficult period:

- Understand the insurance coverage: Review your health insurance policy and understand the coverage it provides.

This will help you anticipate the out-of-pocket expenses and plan accordingly. - Set up a contingency fund: Create an emergency fund specifically dedicated to medical expenses.

Having a financial cushion will reduce stress and help cover unforeseen medical costs. - Communicate with healthcare providers: Discuss payment options and potential financial assistance with healthcare providers.

They may offer payment plans or know of resources available to help with medical expenses. - Explore government assistance programs: Research government assistance programs that provide financial aid for medical expenses.

These can include Medicaid, Children’s Health Insurance Program (CHIP), or other local programs specific to your area. - Seek out community resources: Check if there are local support groups or nonprofit organizations that can provide financial assistance or connect you with resources to help manage the financial impact.

- Reassess budget and prioritize expenses: Adjust your budget to accommodate reduced income or increased expenses.

Focus on essential needs like healthcare, housing, and food while temporarily cutting back on non-essential expenses. - Evaluate employment benefits: Review employee benefits such as paid time off, sick leave, or disability benefits.

These can help alleviate some financial stress during the illness and recovery period. - Seek expert financial advice: Consider consulting a financial advisor or counselor who specializes in assisting individuals and families dealing with parental illness.

They can provide guidance on managing finances and developing a long-term plan. - Take care of your own health: While it is crucial to focus on the ill parent’s health, do not neglect your own physical and mental well-being.

By taking care of yourself, you will be better equipped to handle the financial challenges that arise.

In essence, when a parent falls ill, financial challenges are inevitable.

However, by understanding the challenges, being prepared, and taking proactive steps, families can navigate this difficult time with more financial stability and peace of mind.

Remember, seeking help and support is essential, both for managing finances and ensuring the well-being of all family members involved.

Read: 5 Tactful Ways to Ask Your Spouse for Money

Your Personalized Financial Plan

Get expert financial advice tailored exclusively to your goals. Receive a custom roadmap in just 1-3 business days.

Get StartedAssessing the Financial Situation

When faced with parental illness, it is crucial for individuals to assess their financial situation.

By evaluating and analyzing their current finances, they can better prepare themselves for the challenges ahead.

Evaluate and analyze their current financial situation

Begin by urging readers to gather all necessary financial documents and information.

Emphasize the importance of taking stock of their assets, including savings, investments, and properties.

Advise readers to calculate their total income from various sources, such as salaries, pensions, or rental income.

Encourage readers to review their outstanding debts, such as mortgages, loans, and credit card balances.

Remind readers to assess the coverage and limitations of their health and life insurance policies.

Importance of creating a budget and tracking expenses

Explain that a budget is a vital tool for managing finances during times of parental illness.

Suggest readers create a detailed list of their monthly income and expenses.

Advise readers to prioritize essential expenses like mortgage payments, utilities, and healthcare costs.

Recommend cutting back on non-essential expenses such as dining out or entertainment activities.

Discuss the advantages of tracking expenses meticulously to identify potential areas for savings or adjustments.

Seeking professional financial advice if necessary

Explain that dealing with parental illness can be overwhelming, and professional help may provide valuable guidance.

Encourage readers to consult with financial advisors who specialize in handling challenging circumstances.

Unlock a Debt-Free Future with Our Unique Strategies

Imagine a life unburdened by debt—a reality we help you visualize and achieve. We offer personalized strategies tailored to your unique situation, guiding you step-by-step toward financial freedom.

Start TodayEmphasize the importance of seeking advice before making significant financial decisions or changes.

Discuss the potential benefits of professional assistance in navigating complex financial matters.

Remind readers that seeking help is a sign of strength and proactive financial management.

Assessing the financial situation is a critical step in preparing for the financial challenges associated with parental illness.

By encouraging readers to evaluate and analyze their current financial standing, create a budget, track expenses, and seek professional financial advice if necessary, they can better navigate this difficult time.

Medical Expenses and Insurance

Medical expenses can turn into a formidable financial adversary during a parent’s illness.

To navigate this challenge successfully, it’s essential to delve into the intricacies of health insurance policies.

Understanding health insurance policies and benefits

Begin by dissecting your health insurance policy. Uncover the specifics of coverage, copayments, and deductibles.

Be vigilant about any exclusions or limitations. Understanding these details empowers you to make informed decisions.

Make a habit of reviewing your policy regularly, especially during open enrollment periods.

Policies may undergo changes, affecting your coverage or out-of-pocket costs. Staying informed helps you adapt your financial strategy accordingly.

Maximizing the utilization of health insurance

Proactivity is key when it comes to utilizing health insurance effectively. Schedule preventive check-ups and screenings as recommended.

Early detection not only contributes to better health outcomes but also minimizes the financial impact by preventing more serious and costly conditions.

Explore your policy’s wellness benefits. Some insurance plans offer incentives for healthy behaviors, such as gym memberships or wellness programs.

Unlock Untapped Nigerian Wealth with Our Expert Advice

Imagine accessing investment opportunities others overlook—stocks, bonds, real estate, small businesses tailored to you. We offer personalized advice you won't find elsewhere, guiding you to financial success.

Unlock WealthTaking advantage of these perks can contribute to overall well-being while optimizing your insurance benefits.

Exploring government assistance programs or grants for medical expenses

Government assistance programs and grants can be a lifeline in managing medical expenses.

Investigate programs like Medicaid, which provides health coverage for eligible low-income individuals and families. Determine your eligibility and apply promptly.

Local grants or charitable organizations may offer financial aid for specific medical needs. Research these resources and reach out for support.

Many communities have foundations dedicated to helping families facing medical challenges.

Communicate openly with healthcare providers about your financial situation. Some hospitals or clinics have financial assistance programs for eligible individuals.

Negotiate bills, inquire about discounts, or establish manageable payment plans to ease the burden.

In summary, navigating medical expenses and insurance requires a comprehensive approach.

Understand the nuances of your policy, stay proactive in utilizing benefits, and explore available assistance programs.

By being vigilant and proactive, you can better manage the financial aspects of your parent’s illness.

Read: Effective & Respectful Money Pleas to Friends

Income and Employment

When a parent falls ill, it can have a profound impact on the family’s income and employment.

This section delves into the potential financial challenges that may arise and offers practical tips for managing income during such a challenging time.

Potential impacts on income due to parental illness

Loss of one parent’s income

When a parent becomes ill, they may temporarily or permanently lose their ability to work.

This loss of income can be distressing for the affected family, who now have to cope with reduced financial resources.

It becomes critical to reassess the family budget and make necessary adjustments to meet their needs.

Reduced working hours or career disruptions

The parental illness might also lead to reduced working hours or disruptions in the parent’s career.

Frequent medical appointments, hospital visits, or the need to provide caregiving services may force the parent to quit their job or limit their working hours.

As a result, the family’s income may be significantly reduced, further straining their financial stability.

Managing income during this time

Exploring alternative income sources

During this challenging period, it’s crucial for the family to consider alternative sources of income.

This may involve searching for part-time jobs, freelance opportunities, or remote work that can be managed alongside caregiving responsibilities.

Exploring government assistance programs, grants, or community support can also help alleviate financial strain.

Negotiating flexible working arrangements or paid leave

If the affected parent intends to continue working, they should explore options for flexible working arrangements.

Discussing reduced hours, working remotely, or adjusting the schedule can enable them to balance work and caregiving responsibilities effectively.

Additionally, they can inquire about paid leave options or temporary disability benefits offered by their employer or government agencies to ensure financial stability during the recovery process.

In fact, parental illness can significantly impact the income and employment of a family.

The loss of a parent’s income or disruptions in career can create financial instability.

However, there are steps that families can take to manage their income effectively during this challenging time.

Exploring alternative income sources and negotiating flexible working arrangements or paid leave can provide much-needed financial relief.

By being proactive and seeking support, families can navigate the financial challenges and ensure their survival during the difficult period of parental illness.

Read: Money Matters: The Graceful Asking Technique

Legal and Financial Documents

Having the necessary legal and financial documents in place is crucial when dealing with parental illness.

These documents can help ensure financial survival and provide peace of mind during difficult times.

Importance of Essential Documents

One of the first steps in preparing for the financial challenges of parental illness is to have essential legal and financial documents in place.

These documents serve as a safeguard and allow for effective decision-making.

- Wills: A will is a vital document that outlines how assets will be distributed after a parent’s passing.

It allows individuals to determine who will inherit their property and reduces the risk of conflicts among family members. - Powers of Attorney: A power of attorney grants someone the authority to make legal and financial decisions on behalf of a parent who is incapacitated or unable to handle their affairs.

It ensures that someone trustworthy can manage their finances and assets. - Healthcare Directives: A healthcare directive or living will specifies an individual’s wishes regarding medical treatment in case they become unable to communicate or make decisions.

It provides guidance to healthcare providers and loved ones.

It is crucial to have these documents in place to protect both the parents and their children.

Without them, important decisions may be left to the court or default laws, causing unnecessary stress and financial burden.

Checklist of Important Documents

Parents should ensure they have the following documents prepared and organized:

- Last will and testament

- Power of attorney for finances

- Power of attorney for healthcare

- Living will or healthcare directive

- Trust documents, if applicable

- Insurance policies (life, health, disability, long-term care)

- Bank account and investment statements

- Retirement account information

- Social Security and Medicare/Medicaid information

- Property deeds and mortgage documents

- Vehicle titles and registration

- Debt and loan information

Holding regular discussions with parents about these documents and their location is crucial in preparing for any unforeseen circumstances.

It ensures that everyone involved is aware and has access to the necessary information when needed.

Seek Professional Guidance

Consulting with an attorney or financial advisor is strongly recommended when preparing and updating legal and financial documents.

- Attorney: Seeking guidance from an attorney experienced in estate planning and elder law can help parents understand the legal aspects and requirements for each document. This ensures that everything is correctly executed and valid.

- Financial Advisor: A financial advisor can provide invaluable assistance in reviewing current financial situations, identifying potential gaps in coverage, and recommending suitable insurance policies or investment strategies.

Remember that these professionals specialize in ensuring the financial well-being of individuals and families during challenging times.

Their expertise will help secure important documents and make sound financial decisions.

In short, securing essential legal and financial documents is crucial for the financial survival of families dealing with parental illness.

Through proper preparation, consultation, and regular updates, parents can protect their assets, establish clear instructions, and minimize potential disputes.

It provides a sense of security and allows them to focus on the most important thing: taking care of their loved ones.

Read: Sensitive Money Talks with Friends: Key Strategies

Financial Assistance and Support

Potential Sources of Financial Assistance and Support during Parental Illness

During a parental illness, seeking financial assistance and support can greatly alleviate the burden. There are various potential sources to consider:

Government Programs and Benefits

Many governments offer programs and benefits specifically designed to provide financial assistance during difficult times.

These programs may include healthcare subsidies, income support, or disability benefits.

Researching and understanding the eligibility criteria and application process is crucial.

Non-profit Organizations and Charities

Numerous non-profit organizations and charities are dedicated to supporting families facing parental illness.

These organizations often offer financial aid, counseling services, and other forms of support.

It is important to identify the specific organizations that cater to the needs of your situation and reach out to them for assistance.

Crowdfunding or Fundraising Platforms

In recent years, crowdfunding and fundraising platforms have gained significant popularity and can be a valuable resource for financial support.

These platforms provide a means for individuals to share their stories and request financial contributions from friends, family, acquaintances, and even strangers who empathize with their situation.

Guidance on Researching and Applying for Financial Assistance Options

When researching and applying for financial assistance options, it is essential to approach the process with diligence and thoroughness.

Follow these guidelines to maximize your chances of receiving the support you need:

Identify Relevant Programs

Begin by identifying government programs, non-profit organizations, and charities that specifically cater to the needs of families facing parental illness.

Utilize online resources, directories, and local support networks to compile a comprehensive list.

Review Eligibility Criteria

Thoroughly review the eligibility criteria and requirements for each potential source of financial assistance.

Some programs may have specific income thresholds or medical conditions that need to be met.

Cross-reference your family’s circumstances with these criteria to determine which options align with your situation.

Gather Documentation

Prepare any necessary documentation required for the application process.

This may include medical reports, income statements, proof of residency, and any other supporting documents requested by the programs or organizations you are applying to.

Ensure all documents are organized and readily available.

Submit Applications

Carefully follow the instructions provided by each program or organization when submitting your applications.

Double-check all information for accuracy and completeness.

Keep copies or records of all applications made, including submission dates and any communication received.

Seek Professional Help

If navigating the process becomes overwhelming, consider seeking assistance from professionals, such as social workers or financial advisors.

They can provide guidance, answer questions, and ensure you are maximizing your chances of receiving financial assistance.

Remember, the process of seeking financial assistance may require persistence and patience.

It is essential to explore multiple avenues simultaneously, as some programs may have limited funding or lengthy application periods.

Don’t be discouraged by rejections or delays; continue to research, apply, and stay hopeful.

Emphasizing Self-Care

Importance of self-care during this challenging period

- Make self-care a priority to ensure you can effectively support your parent.

- Recognize that taking care of yourself is not selfish but necessary for your well-being.

- Understand that neglecting self-care can lead to burnout, affecting your ability to help your parent.

- Investing time in self-care will enhance your overall emotional and physical resilience.

Take care of your physical and mental well-being

- Engage in regular exercise to reduce stress and improve your mood.

- Eat a balanced diet to ensure your body receives proper nutrition.

- Get enough sleep to maintain your energy levels and enhance your ability to cope.

- Practice relaxation techniques such as deep breathing or meditation to relax your mind and body.

- Engage in activities you enjoy to uplift your spirits and provide a sense of normalcy.

Seek support from friends, family, or support groups

- Lean on your friends and family for emotional support during this challenging time.

- Share your feelings and concerns with someone you trust, allowing them to offer guidance.

- Consider joining a support group where you can connect with others facing similar challenges.

- Explore online communities or forums where you can find support and advice.

- Remember, you are not alone, and seeking support can provide comfort and valuable insights.

By emphasizing self-care, you can ensure your well-being while still being there for your parent.

Conclusion

Recap the Main Points

In our journey through the financial challenges of parental illness, we’ve emphasized proactive planning.

Create an emergency fund, explore insurance options, and establish open communication with your family about financial matters.

Encouragement and Reassurance

Facing parental illness is daunting, but remember, you’re not alone. Embrace the support of friends, family, and professionals.

Seek solace in the strides you’ve made toward financial preparedness. It’s okay to ask for help; vulnerability is a strength.

Final Words of Guidance and Support

As you navigate this challenging terrain, maintain resilience. Prioritize self-care and mental well-being.

Life’s uncertainties may test you, but the financial groundwork laid out here provides a sturdy foundation. Continue adapting, learning, and growing.

Your financial health intertwines with your ability to support your loved ones. The steps you take today will ripple into a more secure tomorrow.

Remember, it’s not just about weathering the storm but emerging stronger on the other side.

In closing, know that setbacks are temporary, and your commitment to financial survival is commendable.

Embrace the journey, and with each hurdle, you gain strength. Keep the faith, stay adaptable, and forge ahead with the wisdom acquired from navigating the complexities of parental illness.

Take heart in the progress you’ve made. Financial preparedness is an ongoing process, and every step forward is a victory.

You possess the resilience to not only survive but thrive in the face of adversity. May your financial journey be guided by courage, strength, and unwavering hope.