Introduction

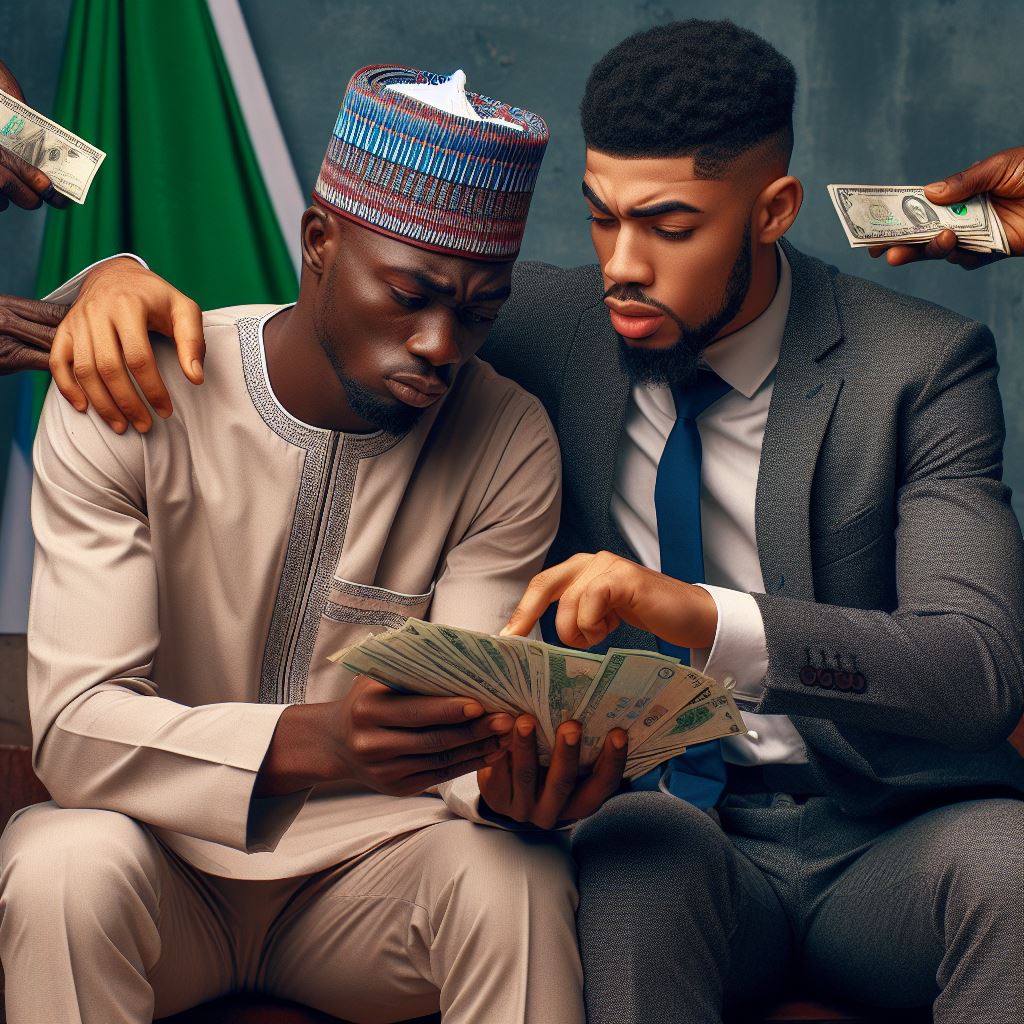

Friend Finance refers to the impact of our friends on our spending habits.

It is crucial to recognize how influential friends can be in our financial decisions.

Friends can heavily influence our spending choices, leading us to make impulsive purchases or adopt unhealthy spending habits.

Being mindful of this influence is vital to ensure our financial well-being and avoid the spend push.

Friends have a significant impact on our spending habits due to the desire to fit in and conform to societal norms.

We often feel the need to keep up with our friends’ lifestyles, leading us to spend money on things we may not actually need or cannot afford.

For example, if our friends go out for expensive dinners or shop at high-end stores, we may feel pressured to do the same, even if it strains our budget.

Moreover, friends can indirectly encourage spending through the activities and experiences they engage in.

If our friends frequently go on extravagant vacations or participate in costly hobbies, we may feel compelled to do the same to maintain our social circle.

This can result in overspending and financial stress.

Recognizing the influence of friends on our financial decisions is essential for taking control of our spending habits.

By being aware of peer pressure and societal expectations, we can make more informed choices about where we allocate our money.

It is crucial to prioritize our long-term financial goals over temporary gratification to avoid falling into excessive debt or financial instability.

In fact, friend finance plays a significant role in our spending habits, as friends can heavily influence our choices.

By being mindful of this influence and making conscious decisions based on our own financial goals, we can avoid the spend push and ensure a healthier financial future.

Your Personalized Financial Plan

Get expert financial advice tailored exclusively to your goals. Receive a custom roadmap in just 1-3 business days.

Get StartedUnderstanding the Spend Push

In the realm of friend finance, navigating the treacherous waters of unnecessary spending can be challenging.

Enter the notorious “spend push,” a term that encapsulates the subtle yet influential pressure friends can exert on one another to indulge in unnecessary expenditures.

To grasp the nuances of friend finance and avoid falling victim to the spend push, it’s crucial to dissect this phenomenon.

The Spend Push and its Relevance to Friend Finance

The spend push is the social force compelling individuals to spend beyond their means, driven by a desire to fit into a particular social circle or meet perceived expectations.

In the context of friend finance, this phenomenon takes center stage as friends inadvertently contribute to each other’s financial missteps.

Whether it’s the latest gadget, trendy fashion, or dining at upscale restaurants, the spend push can manifest in various forms, eroding financial well-being.

Examples of Situations Where Friends Encourage Unnecessary Spending

Picture this: a group of friends eagerly discussing their weekend plans, and the conversation subtly veers towards an extravagant outing that stretches the limits of everyone’s budgets.

The spend push emerges when the pressure to conform to these plans outweighs financial prudence.

Similarly, the allure of group activities, vacations, and social events can often lead to overspending, fueled by the fear of missing out or the desire to maintain a particular image among peers.

The Psychological Aspect of the Spend Push and the Desire to Fit In

At its core, the spend push taps into the psychological need for social acceptance.

The fear of being excluded or labeled as an outsider prompts individuals to align their spending habits with those of their social circle.

This desire to fit in can lead to impulsive purchases, strained budgets, and, ultimately, financial regret.

Understanding the spend push is pivotal in cultivating a healthy approach to friend finance.

By recognizing the psychological triggers behind this phenomenon and actively resisting the pressure to overspend, individuals can fortify their financial foundations and build lasting relationships based on shared values rather than materialistic pursuits.

Unlock a Debt-Free Future with Our Unique Strategies

Imagine a life unburdened by debt—a reality we help you visualize and achieve. We offer personalized strategies tailored to your unique situation, guiding you step-by-step toward financial freedom.

Start TodayIn the world of friend finance, navigating the spend push is not just about managing money; it’s about preserving friendships while staying true to one’s financial principles.

Read: Budget-Friendly Birthday Bash: A Step-by-Step Guide

Recognizing the Signs

As we navigate through the world of personal finance, it’s important to be aware of the influence our friends can have on our spending habits.

Recognizing the signs of the spend push can help us make better financial decisions and avoid unnecessary expenses.

Peer Pressure

One common sign of the spend push is peer pressure.

Friends may encourage us to spend money on things we don’t really need or can’t afford.

They may make us feel like we’re missing out if we don’t join in on their spending activities.

Feeling Obligated

Another sign is feeling obligated to spend.

Sometimes, our friends may expect us to participate in expensive outings or events.

We might feel social pressure to conform and spend money even if it goes against our own financial goals.

Various Tactics

Friends can use various tactics to push us into spending more.

They might constantly talk about the latest trends and make us feel like we need to keep up.

They may also play on our emotions, making us believe that buying certain things will make us happier or more successful.

Reflecting on Our Experiences

It’s essential for us to reflect on our own experiences and identify instances of the spend push in our lives.

Unlock Untapped Nigerian Wealth with Our Expert Advice

Imagine accessing investment opportunities others overlook—stocks, bonds, real estate, small businesses tailored to you. We offer personalized advice you won't find elsewhere, guiding you to financial success.

Unlock WealthHave there been times when we made purchases just to fit in or please our friends? Have we felt pressured to spend money on things we didn’t truly value?

Assessing Peer Influence

Consider the influence your friends have on your financial decisions.

Do they consistently encourage you to spend beyond your means? Are they supportive of your financial goals and help you make responsible choices?

Setting Boundaries

If you notice that certain friends consistently push you to spend, it may be time to set some boundaries.

Have open and honest conversations about your financial goals and limitations.

Surround yourself with friends who respect your choices and support your financial well-being.

Building a Support System

Find like-minded individuals who share similar financial values.

Surrounding yourself with friends who prioritize saving and financial responsibility can help you stay on track and resist the spend push.

Recognizing the signs of the spend push is crucial for maintaining healthy financial habits.

By being aware of peer pressure, feeling obligated to spend, and the various tactics friends may use, we can make more informed decisions and prioritize our financial well-being.

Reflecting on our own experiences and setting boundaries with friends who may push us to spend can lead to a more positive and sustainable approach to Friend Finance.

Read: Thrifty Friendships: Managing Spend

The Financial Consequences

The negative implications of succumbing to the spend push

In the vibrant world of “Friend Finance,” succumbing to the spend push can unleash a cascade of negative financial consequences.

As we delve into the darker side of unchecked spending, it becomes apparent that the repercussions extend far beyond the immediate depletion of one’s bank account.

The impact on personal budgets and financial goals

First and foremost, falling prey to the spend push can wreak havoc on personal budgets.

A well-thought-out budget is akin to a financial roadmap, guiding individuals toward their goals and aspirations.

However, yielding to the allure of excessive spending can send this plan into a tailspin.

Suddenly, the carefully allocated funds for savings, investments, and debt repayments are diverted to impulsive purchases, putting financial stability at risk.

This, in turn, has a profound impact on overarching financial goals.

Whether it be saving for a dream vacation, a down payment on a home, or funding a child’s education, the spend push disrupts the carefully laid out plans.

As aspirations take a backseat to momentary pleasures, the long-term financial landscape becomes uncertain, fostering an environment of financial anxiety and stress.

The potential strain on friendships that can arise from differing spending habits

Moreover, the spend push can strain even the strongest of friendships.

Differing spending habits often lead to disparities in lifestyle and priorities.

When one friend is caught in the whirlwind of impulse spending, it can create tension within the group.

The pressure to conform to a spending standard can cause resentment and discomfort, eroding the foundation of trust that friendships are built upon.

Conversations about finances, once taboo, become unavoidable, potentially leading to misunderstandings and strained relationships.

In essence, the financial consequences of succumbing to the spend push extend beyond mere numbers on a bank statement.

It jeopardizes personal financial well-being, derails long-term goals, and, perhaps most significantly, casts a shadow over the camaraderie of friendships.

As we navigate the intricate terrain of “Friend Finance,” it’s crucial to recognize the pitfalls of unchecked spending and strive for a balance that fosters both financial prosperity and lasting relationships.

Read: Financial Fences: Keeping Friends Out

Strategies to Avoid the Spend Push

Are you tired of constantly feeling pressured to spend money whenever you are with your friends? It’s time to break free from this cycle and take control of your finances.

Here are some practical tips and techniques to resist the spend push:

Setting a Budget

Before heading out with your friends, set a spending limit for yourself.

Determine how much you can afford to spend and stick to it.

This will help you avoid overspending and keep your financial goals intact.

Planning Activities That Don’t Require Spending

Instead of always going out for expensive meals or drinks, suggest alternative activities that don’t involve spending money.

Organize a potluck at someone’s house, have a movie night, or go for a hike in the great outdoors.

There are countless ways to have fun without breaking the bank.

Communicating Your Financial Goals

Openly discuss your financial goals and limitations with your friends.

Let them know that you are trying to save money or pay off debt, and ask for their understanding and support.

True friends will respect your decisions and find ways to enjoy each other’s company without pressuring you to spend.

Being Selective with Social Events

You don’t have to attend every social event that comes your way.

Be selective and choose the ones that align with your budget and priorities.

It’s okay to decline an invitation if you know it will put unnecessary strain on your finances.

Finding Free or Low-cost Activities

Do some research and discover free or low-cost activities in your area.

Attend community events, explore local parks, or take advantage of museums with free admission days.

These activities can be just as enjoyable and fulfilling as expensive outings.

Taking Turns Hosting

If going out for meals is a common activity with your friends, suggest taking turns hosting dinner or cooking together at home.

It’s a great way to bond, have a delicious meal, and save money at the same time.

Learning to Say No

One of the most important strategies to avoid the spend push is to learn to say no.

Be firm and confident in your decision not to spend money when you don’t feel comfortable or it doesn’t align with your financial goals.

Looking for Discounts and Deals

When you do decide to spend money, make sure you look for discounts and deals.

Use coupons, shop during sales, and take advantage of loyalty programs.

Saving money while still enjoying the company of your friends is a win-win situation.

Surrounding Yourself with Like-minded Individuals

If constantly being pressured to spend money is causing you stress, consider expanding your social circle to include like-minded individuals who share similar financial goals.

Surrounding yourself with people who value financial responsibility can provide motivation and support.

Focusing on Experiences, Not Things

Remember that true happiness and fulfillment come from experiences, not material possessions. Instead of constantly buying things to keep up with your friends, focus on creating lasting memories through shared experiences.

By implementing these strategies, you can avoid the spend push and maintain a healthy financial life while still enjoying quality time with your friends.

Remember, it’s not about how much money you spend, but the meaningful connections you build.

Read: Money Mates: Saying No to Spending

Cultivating a Positive Financial Mindset

Emphasizing the importance of individual financial responsibility and staying true to personal goals is crucial.

To truly succeed in managing our finances, it’s essential to surround ourselves with like-minded individuals who support our financial well-being.

We are greatly influenced by the people we interact with on a daily basis, and this includes our financial habits.

The Value of Surrounding Oneself with Like-minded Individuals

- Support and Accountability: When we surround ourselves with individuals who have similar financial goals, they can provide us with support and hold us accountable for our actions.

- Shared Experiences: Interacting with like-minded individuals allows us to share experiences, tips, and advice on how to effectively manage our finances.

- Motivation and Inspiration: Being around people who are financially responsible and successful can inspire us to work towards our goals and make better financial choices.

- Positive Influence: When our social circle includes individuals who prioritize financial well-being, we are more likely to adopt their positive habits and attitudes towards money.

Actively Seeking Positive Financial Influences and Role Models

If we want to cultivate a positive financial mindset, it’s important to actively seek out positive financial influences in our social circle.

Here are some steps to help you find and connect with individuals who can inspire and guide you:

- Join Financial Communities: Attend workshops, seminars, or join online communities focused on personal finance. These platforms provide opportunities to meet like-minded individuals.

- Find a Mentor: Look for someone who has achieved financial success and is willing to mentor you. A mentor can provide guidance and help you stay on track.

- Engage in Conversations: Initiate discussions about personal finance with friends and family. Exchange ideas, share experiences, and learn from one another.

- Follow Financial Experts: Follow influential financial experts on social media or subscribe to their blogs/podcasts. They can provide valuable insights and tips.

- Attend Networking Events: Participate in networking events related to finance or entrepreneurship. These events provide a platform to connect with inspiring individuals.

Remember that cultivating a positive financial mindset is an ongoing process. It requires continuous effort and dedication.

By surrounding ourselves with like-minded individuals and seeking positive financial influences, we create an environment that supports our financial goals.

However, it’s important to note that we should also be mindful of negative influences that can derail our progress.

Avoiding Negative Financial Influences

While seeking positive financial influences is important, it’s equally crucial to identify and avoid negative influences:

- Limit Exposure to Negative Media: Constant exposure to sensationalized or fear-based financial news can influence our attitudes and decisions negatively.

- Avoid Envious Comparisons: Comparing ourselves to others based on material possessions can lead to poor financial choices and unnecessary spending.

- Stay Away from Impulsive Spenders: Being around individuals who have a habit of impulsive and irresponsible spending can lead us astray.

- Resist Peer Pressure: Don’t succumb to the pressure of keeping up with others’ spending habits or lifestyle choices.

- Distance Yourself from Financially Irresponsible Individuals: If someone consistently displays irresponsible financial behavior, it’s best to limit their influence in our lives.

By actively cultivating a positive financial mindset and surrounding ourselves with like-minded individuals, we pave the way for financial success.

Remember, we have the power to shape our financial future, and the choices we make today determine our path tomorrow.

Conclusion

We have discussed the importance of being aware of the spend push in Friend Finance.

It is crucial to understand how our friends’ spending habits can influence our own financial decisions.

By recognizing the potential impact, we can take control of our personal finances and find a balance between friendship and financial well-being.

Remember, it is essential to prioritize our own financial goals and make informed choices.

While maintaining healthy friendships, we must also remain mindful of our own financial boundaries.

Ultimately, being aware of the spend push allows us to avoid unnecessary expenses and maintain a stable financial future.

So, take charge of your financial decisions and don’t let peer pressure dictate your spending habits.

By finding a balance between friendship and financial well-being, we can ensure a more secure financial future.

Now is the time to empower ourselves and make smart choices that align with our personal financial goals.

Remember, it’s not about isolating ourselves but rather being aware and conscious of our own financial needs.

Together, we can create a supportive network that encourages responsible spending and long-term financial success.