Introduction

Digital money, the backbone of modern transactions, transcends traditional currencies. It’s a virtual currency revolutionizing financial landscapes globally.

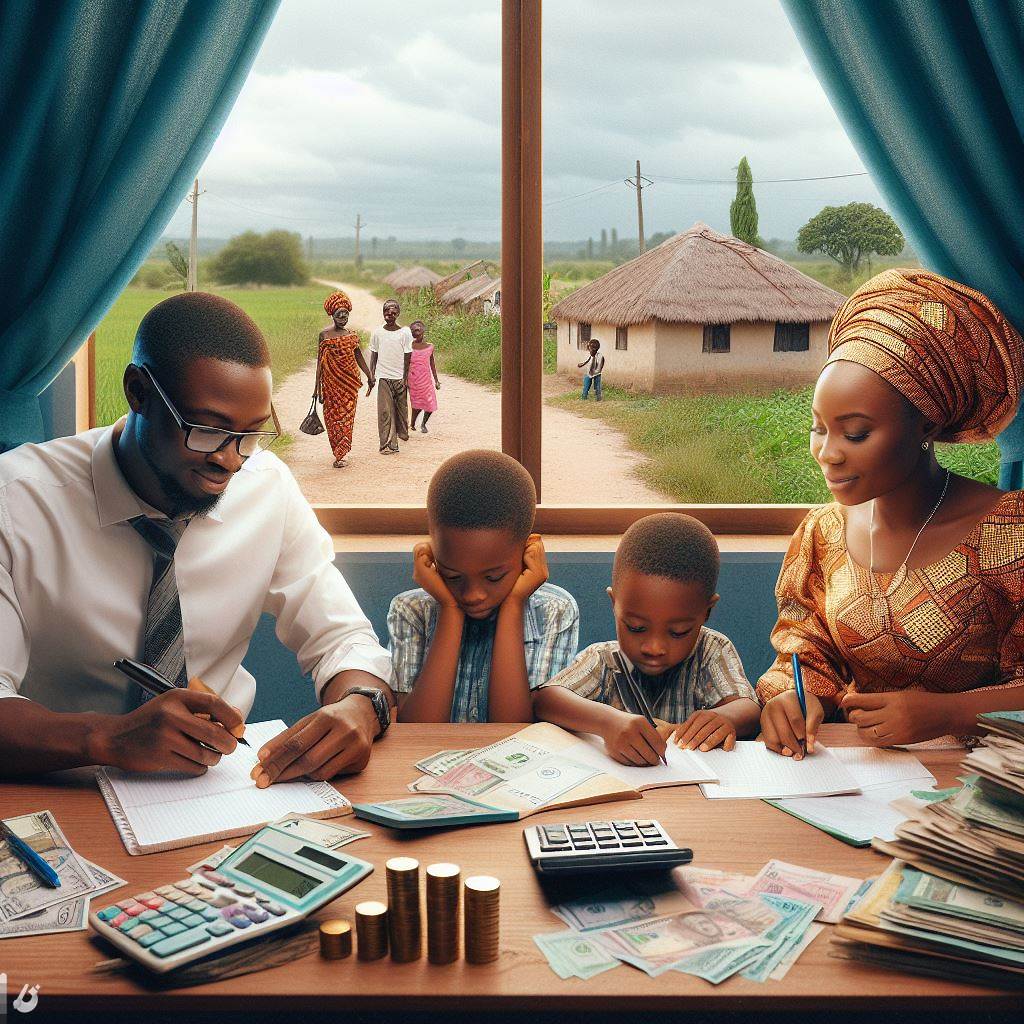

Importance of Teaching Kids about E-Finance

Instilling financial literacy early is paramount. In an increasingly digital world, understanding e-finance empowers children to navigate a complex financial future.

Financial education equips them with essential skills, fostering responsible money management habits from a young age.

With digital money becoming ubiquitous, teaching kids about e-finance becomes a necessity.

Understanding the basics of digital money lays a foundation for informed decision-making.

Kids grasp the concept of electronic transactions, digital wallets, and online banking effortlessly.

Incorporating e-finance into education prepares children for the evolving economy, ensuring they’re not left behind.

As society becomes cashless, possessing digital literacy becomes as crucial as traditional financial skills.

Moreover, e-finance education enhances critical thinking.

Kids learn to discern between legitimate online transactions and potential risks, cultivating a sense of online security.

Teaching kids about digital money promotes financial responsibility, steering them away from impulsive spending habits.

They develop an understanding of budgeting and saving in the digital realm.

In essence, this post introduces the concept of digital money and emphasizes the necessity of teaching kids about e-finance.

The importance lies in shaping a financially literate generation capable of navigating the digital financial landscape confidently.

Benefits of Teaching Kids about Digital Money

Teaching kids about digital money comes with numerous benefits, including:

Your Personalized Financial Plan

Get expert financial advice tailored exclusively to your goals. Receive a custom roadmap in just 1-3 business days.

Get StartedFinancial literacy and awareness

- Introducing kids to digital money educates them about the concept of finances from an early age.

- They learn about electronic transactions, budgeting, and the value of money in a digital world.

- Understanding digital money enables kids to make informed financial decisions as they grow older.

Developing responsible money management skills

- Teaching kids about digital money instills the importance of responsible money management.

- They learn to track their digital transactions, prioritize needs over wants, and avoid unnecessary expenses.

- Children become aware of saving, budgeting, and planning for the future using digital tools.

Preparing kids for a digital future

- In an increasingly digital world, teaching kids about digital money prepares them for future financial transactions.

- As technology advances, physical currency is gradually being replaced by digital forms of payment.

- Equipping kids with knowledge about digital money ensures they will navigate this future seamlessly.

Fostering independence and decision-making abilities

- Learning about digital money empowers kids to make independent financial choices.

- They gain the confidence to handle and manage their own finances as they grow older.

- Understanding digital money helps children develop critical thinking and decision-making skills.

In essence, teaching kids about digital money offers numerous benefits.

It enhances financial literacy, promotes responsible money management, prepares them for the digital future, and fosters independence and decision-making abilities.

Read: Earning Money: Ideas for Young Minds

Age-Appropriate Methods to Teach Kids about Digital Money

Teaching kids about digital money is crucial in today’s technologically advanced society.

As cash transactions become less common and digital payments become the norm, it is important to equip children with the necessary knowledge and skills to navigate the world of e-finance.

By starting early and using age-appropriate methods, parents and educators can effectively teach kids about digital money in a way that is engaging and impactful.

Start early with basic money concepts

Starting early with basic money concepts is essential.

Introducing the concept of saving and spending at a young age helps children understand the value of money and the importance of making wise financial decisions.

By teaching kids to set aside money for savings and to carefully consider their spending choices, they develop responsible financial habits early on.

Utilize educational games and apps

Utilizing educational games and apps is another effective way to teach kids about digital money.

Interactive apps specifically designed for money management education engage children in a fun and interactive manner.

These apps provide simulations and challenges that allow kids to practice making financial decisions and see the consequences in a controlled virtual environment.

Additionally, virtual stores and financial simulations can introduce real-life scenarios, teaching kids the skills they need to successfully navigate digital transactions.

Allow children to earn and manage their own digital money

Allowing children to earn and manage their own digital money is also beneficial in teaching them about responsibility and financial management.

Unlock a Debt-Free Future with Our Unique Strategies

Imagine a life unburdened by debt—a reality we help you visualize and achieve. We offer personalized strategies tailored to your unique situation, guiding you step-by-step toward financial freedom.

Start TodayCreating virtual allowances or rewards systems can give kids a sense of ownership and teach them the value of hard work.

By having their own digital money to manage, children learn about budgeting, saving, and making choices based on their financial capabilities.

Furthermore, encouraging entrepreneurship through online platforms can provide valuable learning experiences for children.

Platforms that support young entrepreneurs allow kids to showcase their talents and ideas, while also teaching them about marketing, pricing, and managing financial transactions.

This hands-on approach not only instills important financial skills but also fosters creativity and confidence in children.

In fact, teaching kids about digital money requires age-appropriate methods that are engaging and effective.

Starting early with basic money concepts, utilizing educational games and apps, and allowing children to earn and manage their own digital money are all key approaches to ensure children develop the necessary knowledge and skills for e-finance.

By equipping children with these skills, we empower them to navigate the digital financial landscape responsibly and confidently.

Read: Real Estate in Nigeria: Boom or Bust for Land?

Teaching Responsible Online Financial Behavior

Teaching kids about e-finance not only involves educating them about the basic concepts of money and financial management, but also training them to become responsible online consumers.

In today’s digital age, it is crucial for children to understand how to protect their personal information and make wise financial decisions while using online platforms.

Emphasize online security and protecting personal information

One of the fundamental aspects of teaching responsible online financial behavior is educating children about online security and the importance of protecting their personal information.

Kids should be aware of the potential risks associated with sharing sensitive data online, such as their full name, home address, or bank details.

To begin with, it is essential to teach kids about secure websites and trusted payment methods.

Unlock Untapped Nigerian Wealth with Our Expert Advice

Imagine accessing investment opportunities others overlook—stocks, bonds, real estate, small businesses tailored to you. We offer personalized advice you won't find elsewhere, guiding you to financial success.

Unlock WealthTeach them how to recognize websites with encrypted connections (https://) and explain the significance of the padlock icon in the browser’s address bar.

In addition to secure websites, discuss the importance of creating strong passwords.

Teach kids about password complexity, including the use of a combination of letters, numbers, and special characters.

Emphasize the importance of not sharing passwords with anyone.

Furthermore, educate children about common online scams and how to avoid falling victim to them.

Teach them to be skeptical of emails or messages asking for personal information and to verify the authenticity of such requests through reliable sources.

Explain the risks and benefits of online shopping

Another crucial aspect of teaching responsible online financial behavior is helping children understand the risks and benefits of online shopping.

While online shopping offers convenience and a wide variety of options, it is important for kids to develop a discerning eye when making online purchases.

Teach children to identify trustworthy online stores by discussing factors such as customer reviews, established brands, and secure payment options.

Help them understand the significance of checking for trust signals on websites, such as trust badges or seals.

Additionally, instill the importance of comparison shopping among children.

Teach them to research and compare prices, features, and customer feedback before making a purchase.

Encourage them to look for the best value for their money.

Moreover, educate kids about the dangers of impulse buying online.

Emphasize the importance of thinking critically and considering the necessity and utility of a product before making a purchase.

Teach them to differentiate between wants and needs.

Teaching responsible online financial behavior to kids lays the foundation for their future financial decision-making skills.

By emphasizing online security, protecting personal information, and educating them about the risks and benefits of online shopping, we can empower children to become smart and responsible digital consumers.

Read: Understanding Needs vs. Wants: Kids’ Guide

Encouraging Digital Philanthropy and Giving

In today’s digital age, teaching kids about financial literacy goes beyond traditional concepts such as saving and budgeting.

It is important to also empower them with knowledge about digital money and how they can use it to positively impact the world.

One way to do this is by encouraging digital philanthropy and giving.

Teach kids about digital donations and crowdfunding

Teaching kids about digital donations and crowdfunding allows them to understand the importance of supporting causes they care about.

By promoting empathy and social responsibility, kids learn to put themselves in other people’s shoes and recognize the challenges they may face.

This not only develops their understanding of the world but also instills a sense of care for others.

In addition, discussing the impact of online giving can help kids realize the collective power of their contributions.

By explaining how small individual donations can come together to make a big difference, they will understand that even their small acts of kindness can have a significant impact on someone’s life.

This knowledge empowers them to be active participants in creating positive change.

Engage kids in helping others through digital platforms

Engaging kids in helping others through digital platforms provides practical ways for them to make a difference.

Encouraging volunteering through virtual platforms allows them to engage in meaningful activities from the comfort of their own homes.

They can contribute their time and skills to various online volunteering opportunities, such as tutoring, mentoring, or even participating in virtual fundraisers.

Furthermore, it is crucial to raise awareness about online charity drives.

By educating kids about different digital platforms that facilitate online giving, they will have a broader understanding of the various ways they can contribute to causes they care about.

This awareness also helps them make informed decisions about where and how they want to allocate their resources and support.

In general, teaching kids about digital philanthropy and giving is essential in today’s interconnected world.

By promoting empathy, discussing the impact of online giving, encouraging virtual volunteering, and raising awareness about online charity drives, we empower kids to become active participants in creating positive change.

Through these lessons, they learn the value of using digital money not just for personal gain but also for the betterment of society.

Read: Navigating Land Purchase: Tips for Nigerian Buyers

Conclusion

In the whirlwind of modernity, imparting e-finance skills to kids is paramount. Equip them early for the digital frontier.

Parents, be pioneers! Commence the e-finance journey early, utilizing age-suited tools. Lay the foundation for fiscal acumen.

Imagine a future where your child navigates the digital financial realm with finesse.

E-finance education bequeaths lifelong skills: budgeting, investing, and discerning transactions.

Start now; empower your child with financial literacy, an invaluable gift that transcends generations.

The benefits are vast: prudent decision-making, economic independence, and resilience.

Picture your child confidently managing a digital wallet, making informed choices, and understanding the nuances of virtual transactions.

The seeds planted today blossom into a financial garden of tomorrow.

As your child grows, so does their understanding of e-finance, evolving from basics to intricate financial concepts.

This education serves as a compass, guiding them through the complexities of an increasingly cashless society.

Moreover, instilling these skills fosters a sense of responsibility.

Kids learn the value of money, the importance of saving, and the consequences of impulsive spending.

These lessons sculpt a financially savvy individual capable of navigating a dynamic economic landscape.

E-finance education is not merely a lesson but a lifelong asset.

Parents, seize the opportunity, sow the seeds, and watch as your child blossoms into a financially astute and confident individual, ready to conquer the digital world.